Dividends from stocks are truly passive in nature.

You are doing nothing apart from holding them in your investment portfolio and they pay a share of their profits to you in the form of dividends.

If you are looking to build a dividend portfolio in Canada, you are in the right place.

Let’s look at how much you need to invest to make $100 per month in dividends.

How to find how much dividend a company pays per year?

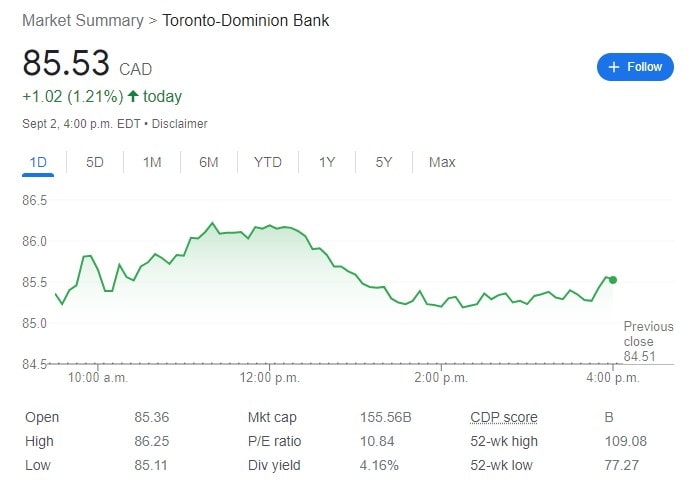

In the picture, you should check for ‘Div yield’ in the last row, it is listed as 4.16%

This means that TD Bank pays 4.16% of its current share price as dividends to its shareholders. This is for the whole year.

Most companies pay every quarter and TD will pay 1/4th of 4.16% of its share price as dividends every quarter.

How much do you need to invest to get $100 per month in dividends?

$100 per month means $1200 in total annual dividends.

The question here is how much you need to invest in a company to receive an annual dividend of $1200. A lot depends on the dividend yield percentage of the company/companies you invest in.

It’s simple math.

If 4.16% of your total value of TD stocks amounts to $1200, what is 100% of your total value of TD stocks?

(100/4.16)*1200 = $28,846

So, you will need to invest $28,846 in TD Bank’s stocks to receive a dividend of $1200 per year (equates to $100 per month)

Are you wondering how many shares of TD you will have to own to get such dividends? We’ve got you covered.

Divide $28846/$85.53 (current price of 1 share of TD Bank)

The answer is 337 shares.

Note: The above calculations are based on the current price of TD Bank’s shares. If the price goes up or down, your dividends may go up or down.

Things to consider while buying dividend stocks

- Don’t go all-in on one dividend paying stock. Always diversify your investments.

- There are stocks that offer a dividend yield of even more than 10% but high dividend doesn’t always translate to high returns in the long run. There are companies that have a low dividend yield but have grown leaps and bounds in the long term.

e.g.: Apple pays a dividend yield of just 0.59% but has grown 659% in the last ten years.

Popular Canadian dividend stocks

Stocks | Dividend Yield | Investment required for $1200/year in dividends |

Enbridge (ENB) | 6.33% | $18957 |

Manulife (MFC) | 5.85% | $20512 |

Telus Corporation (T) | 4.56% | $26315 |

TD Bank (TD) | 4.16% | $28846 |

CIBC (CM) | 5.38% | $22304 |

The above stocks are just examples and not stock recommendations. When you identify your dividend stocks, use this formula to calculate how much you need to invest to get $1200 per year in dividends.

(100/Dividend Yield %)*1200 = Investment Required

Happy Investing. Start now.