My Crypto Portfolio – Jan 2022 Update

Cryptos have been super hot lately with the advent of NFTs, metaverse and Web 3.0 – It’s time to share my crypto portfolio.

Disclaimer: This article is not financial advice or crypto advice. All content on this website is for educational purposes only.

I started investing in Cryptos in early 2018 after Bitcoin reached around $20000 in December 2017.

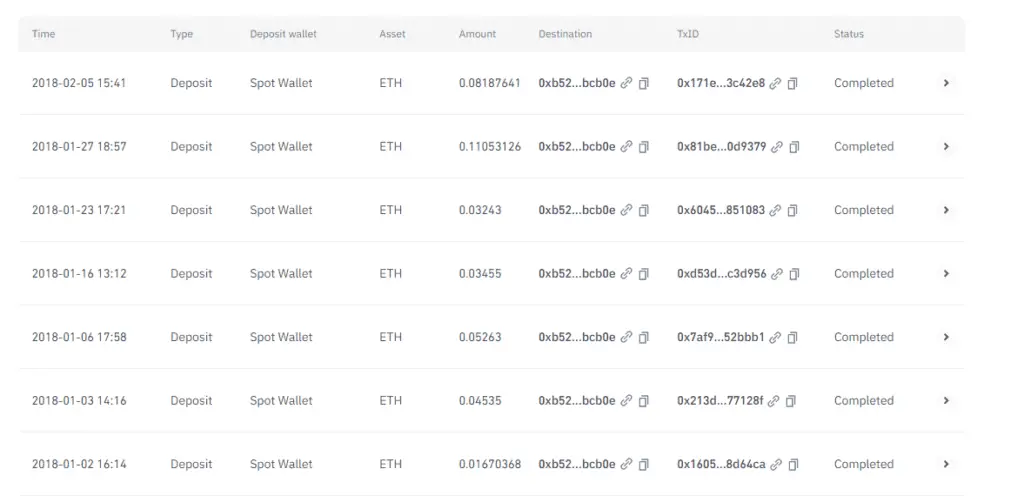

I invested around $500 in Ethereum over a couple of months in 2018 as you can see below.

I added all up, and it is 0.35 ETH

Just like every newbie crypto investor, I wanted to catch the next big thing early and ended up exchanging ETH to buy a wide array of alt coins.

Here are some of the coins I held for over 3 years – AAVE, ADA, TRX, XRP, IOST and so many other smaller and lesser-known alt coins.

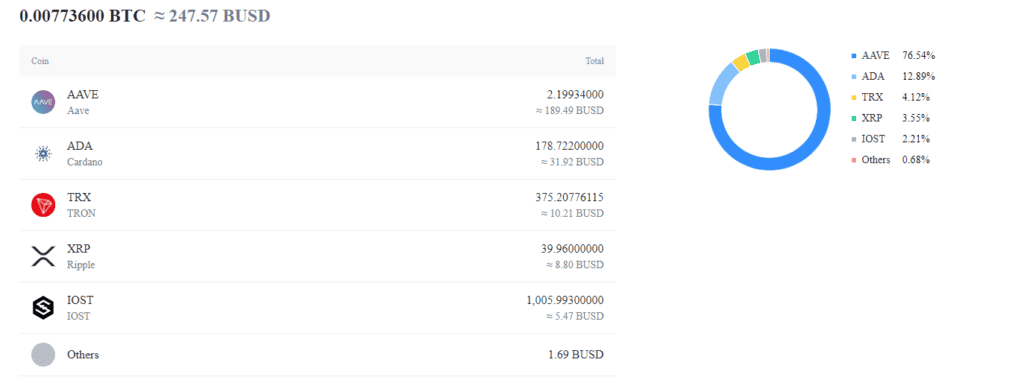

Cut to January 1, 2021 this is how my portfolio looked like. Remember I started with $500

Yes, it went down by 50%

Here’s the thing with crypto. My solid advice is to only invest money that you are prepared to lose, especially with cryptos. So, I just let it ride.

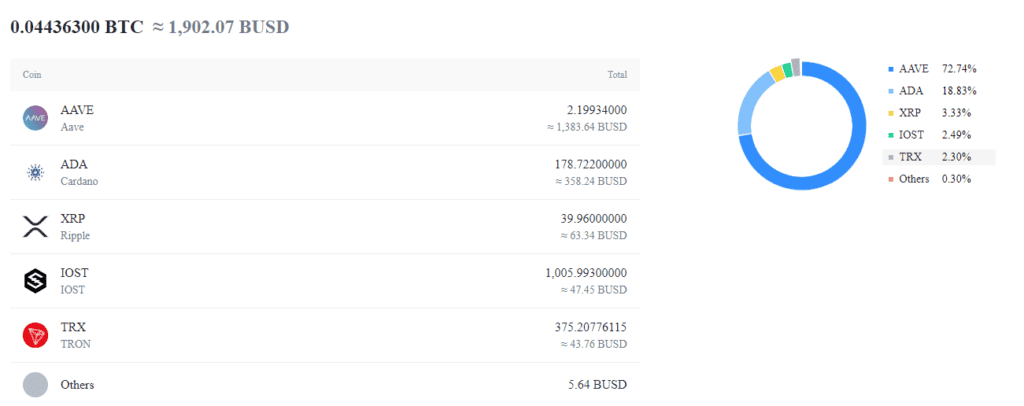

In mid of May 2021, I logged into Binance, and I was in for a pleasant surprise.

My portfolio had grown by almost 8x to $1900

All thanks to 1 alt coin – AAVE which had the lion’s share in the act.

I should have sold it then, but greed got in the way, and I thought of holding it for longer.

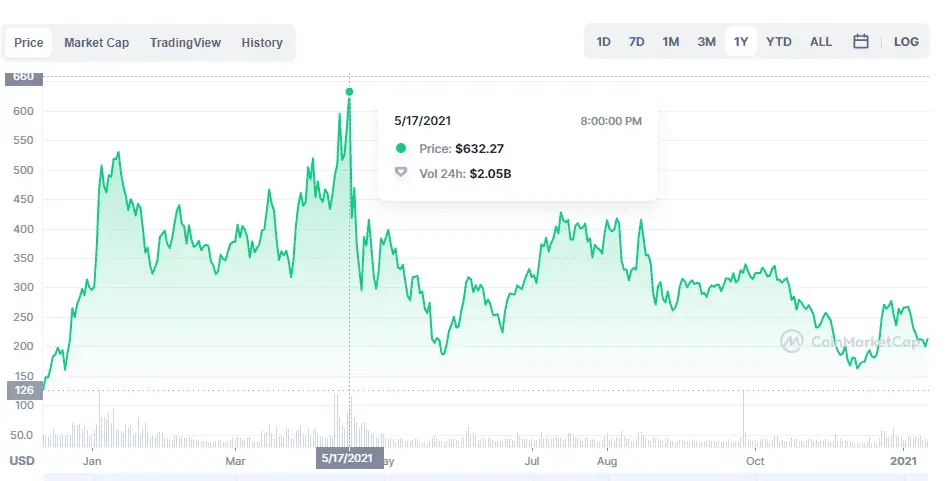

Eventually I ended up selling AAVE at around $300 per coin in the month of November 2021.

Now its trading at around $200 a piece and glad I sold at $300.

In December 2021, I had to move all my crypto portfolio from Binance as it was shutting down in Ontario from 2022.

So, let’s look at my current crypto portfolio as of Jan 11, 2022

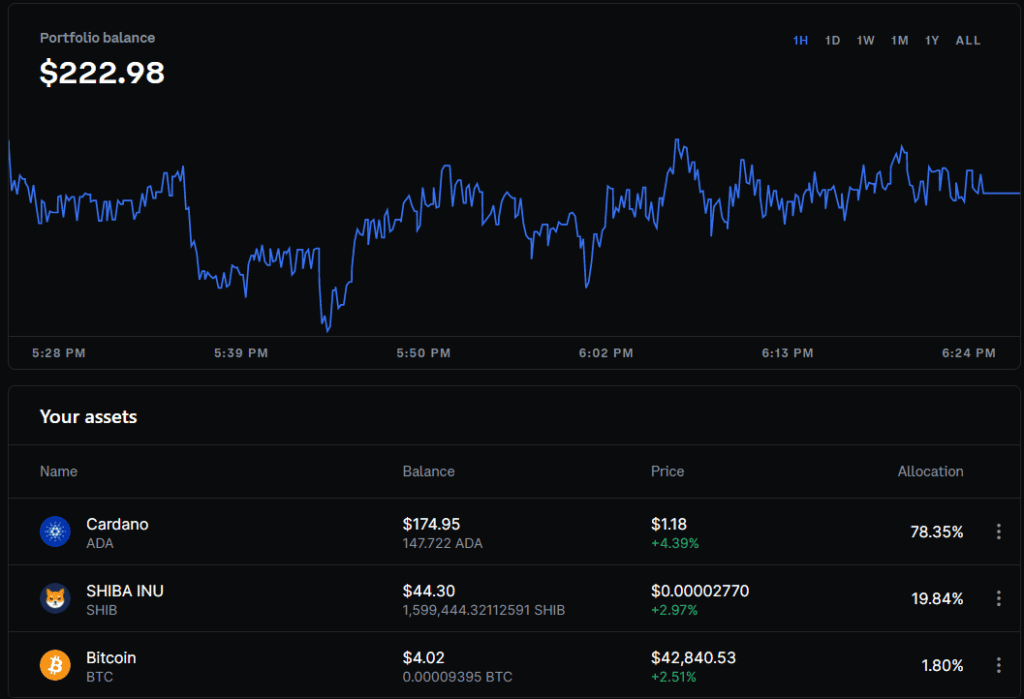

First is my Coinbase account that has just three coins – Cardano, Shiba Inu and Bitcoin accounting to a total of $223

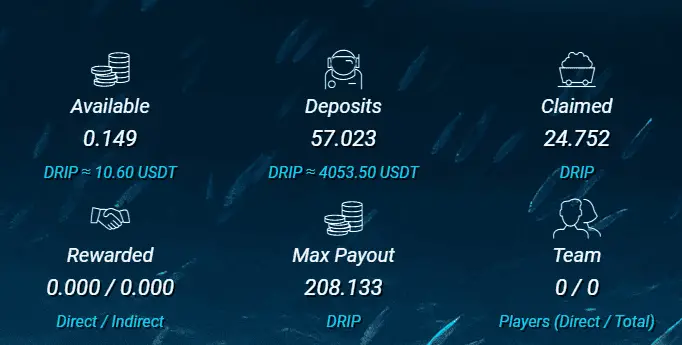

Second is my DRIP portfolio. Here’s the snapshot as of Jan 11, 2022

I sold most of my alt coins on Binance and invested around $1000 into DRIP network in Nov 2021 and it has now grown to $4053.

I am planning to compound daily to increase my DRIP tokens. It pays 1% daily and you can read more about it here.

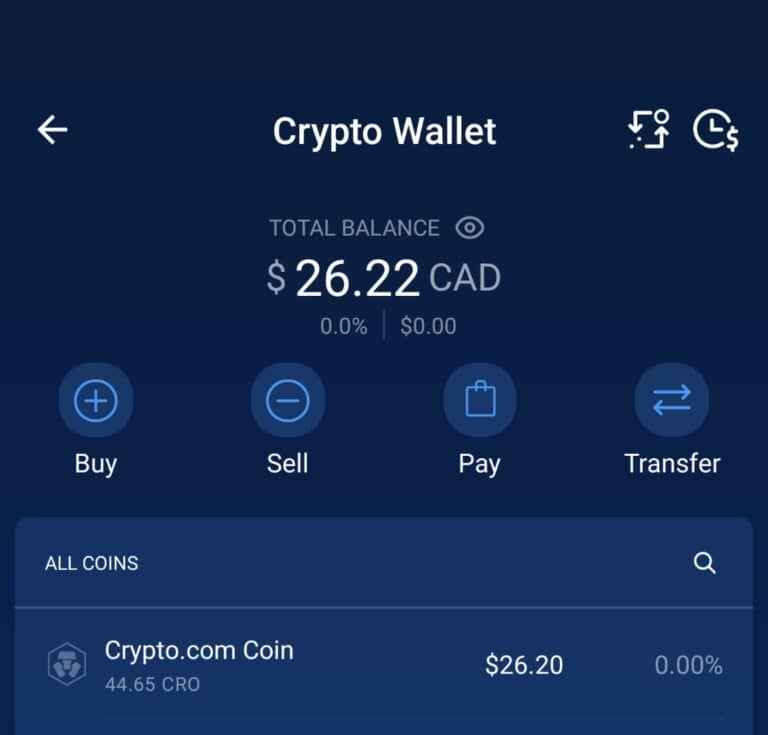

Third and final is my Crypto.com account. Snapshot below. Get $25 when you sign up to Crypto.com using this link.

So, putting everything together, my crypto portfolio is worth around USD 4300

Hope you enjoyed reading this portfolio round up and if you would like to see a snapshot every month, let me know in the comments.

Happy Investing.

How did the US Federal Elections affect my small portfolio?

The highs and lows in the stock market are often triggered by catalysts. What can be a better catalyst than the US Federal Elections?

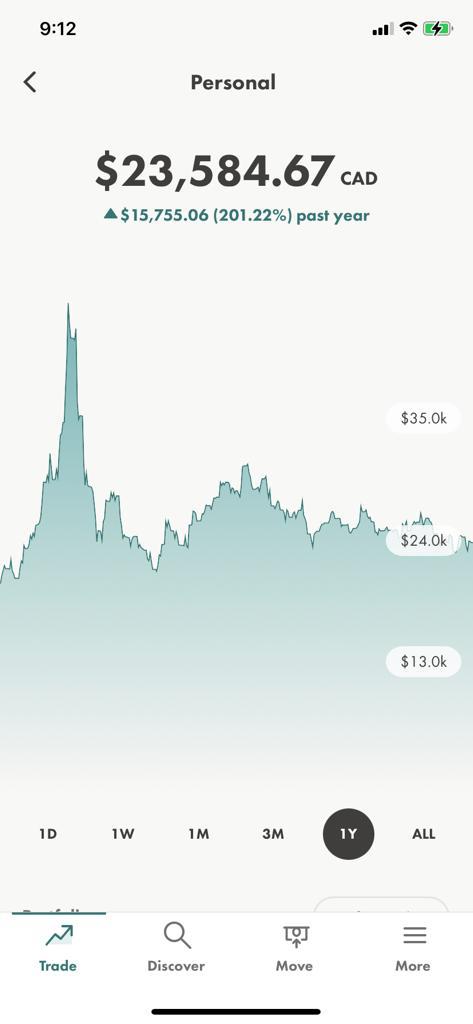

I started investing right before the pandemic hit and I continued to invest around $1k every month since March 2020 in the US and Canadian stock markets.

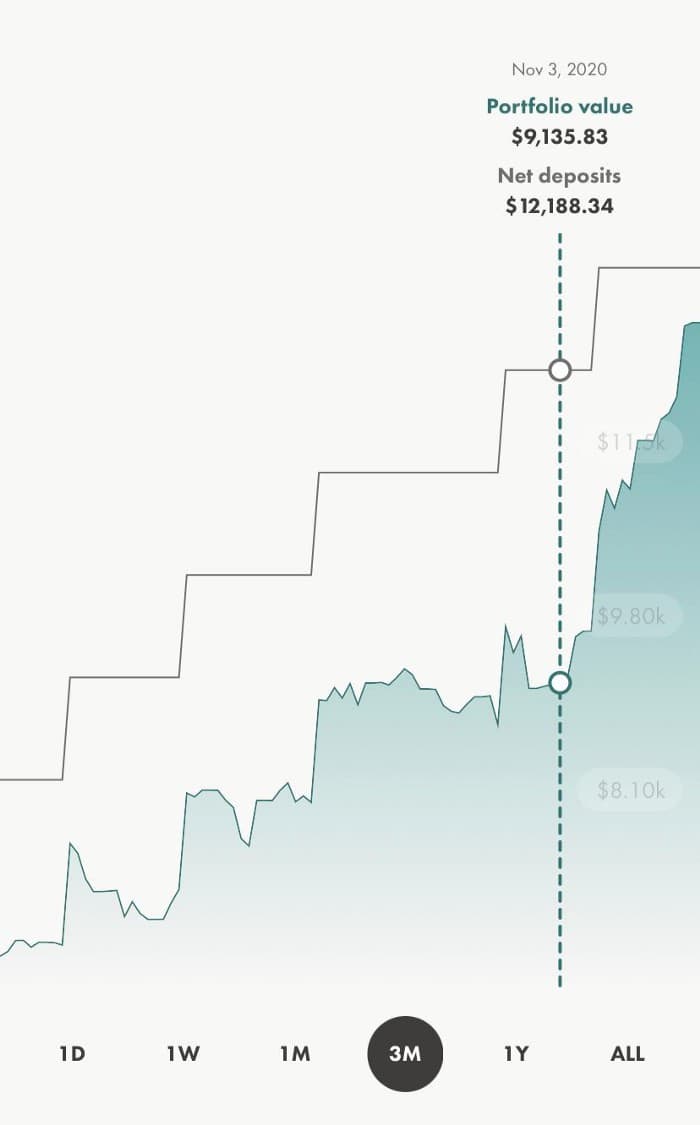

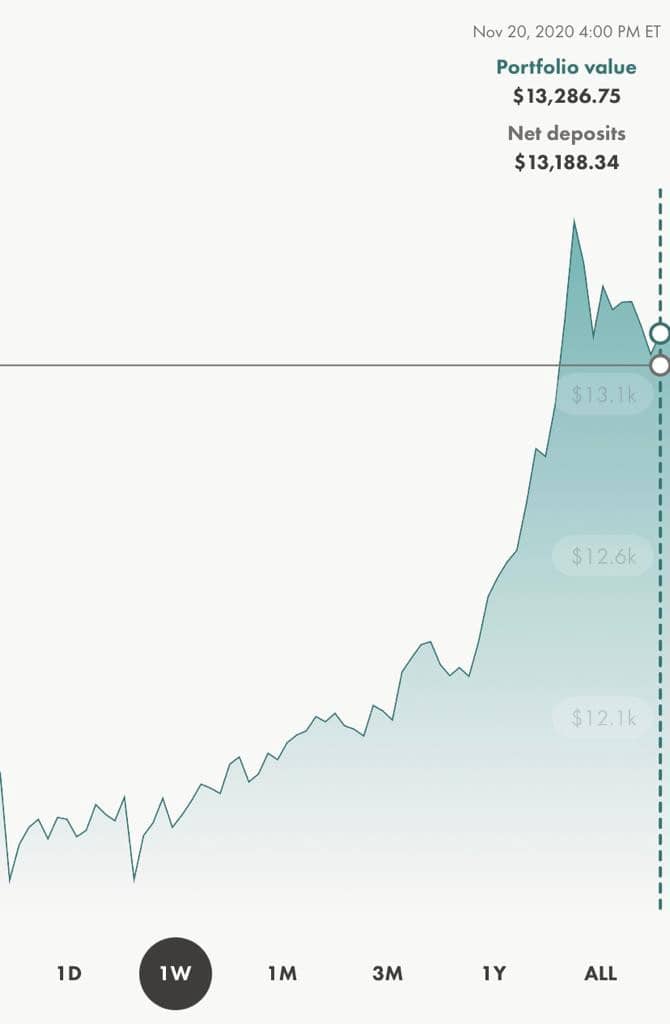

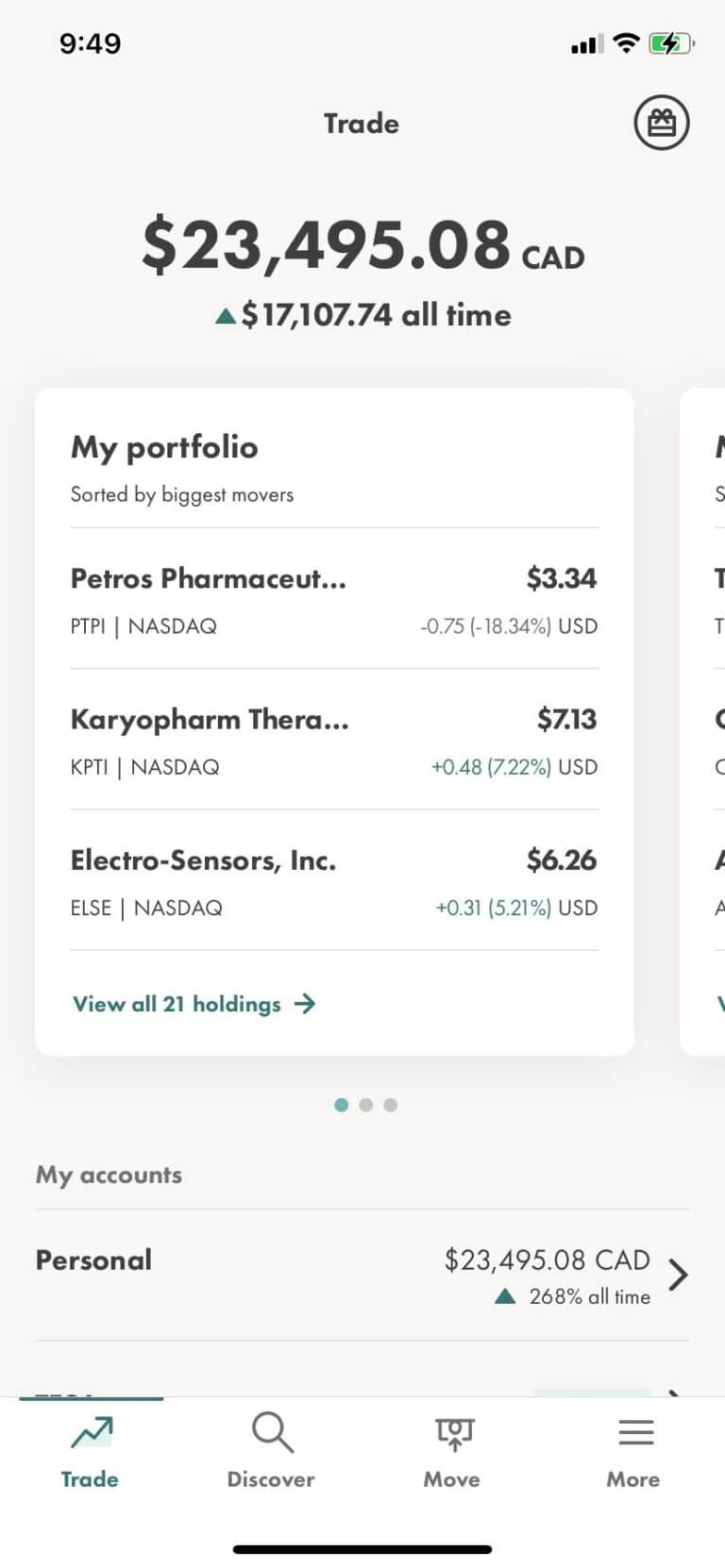

Let’s get right into the numbers. As of November 3, 2020 I had invested a total of $12188 into my Wealthsimple Trading app and my portfolio value was a grand $9135 😂

Yes, I was in negative territory (-25% to be exact).

Here’s a snapshot of the same.

The US Federal Elections took place on November 3, 2020

As you can see, I just added another $1k for the month of November (which explains the increase from 12188 to 13188 in Net deposits).

What was really surprising was the increase in my overall portfolio value.

It increased by over $3000 in just two weeks. Talk about market volatility.

How did this happen?

During September 2020, I read multiple articles on what would happen to the US stock market if Donald Trump won again or if Joe Biden won.

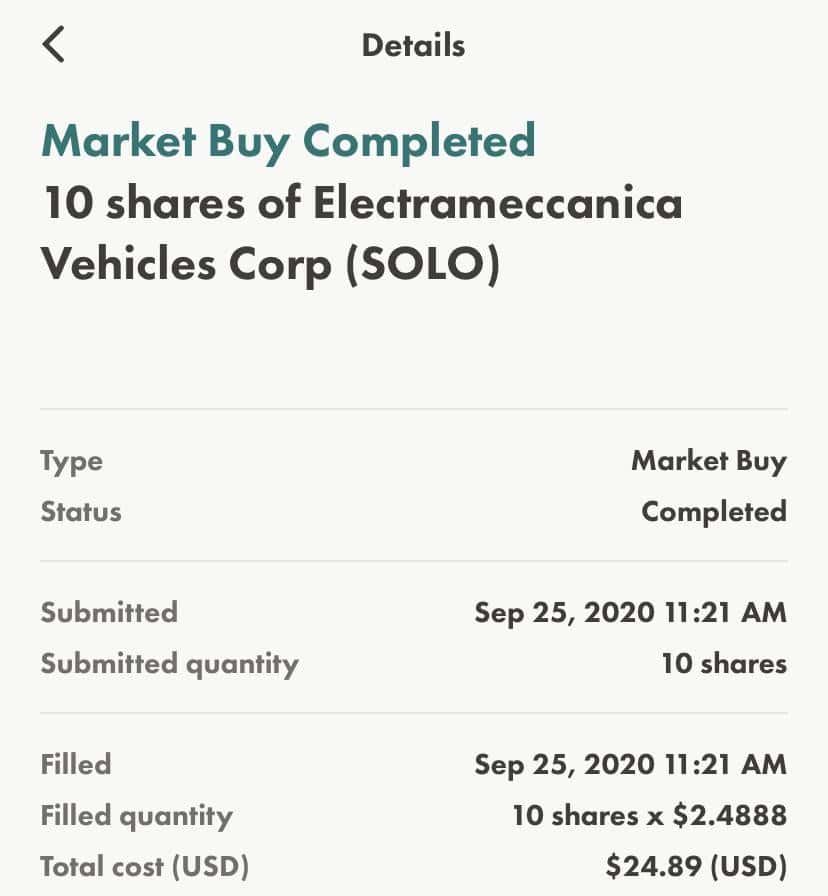

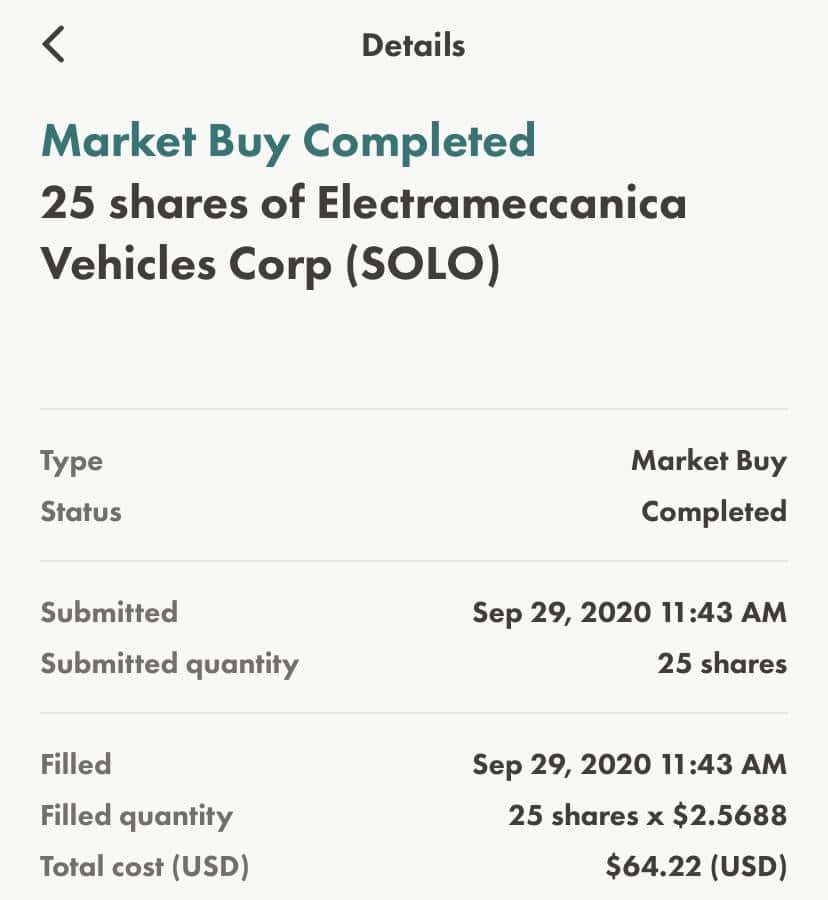

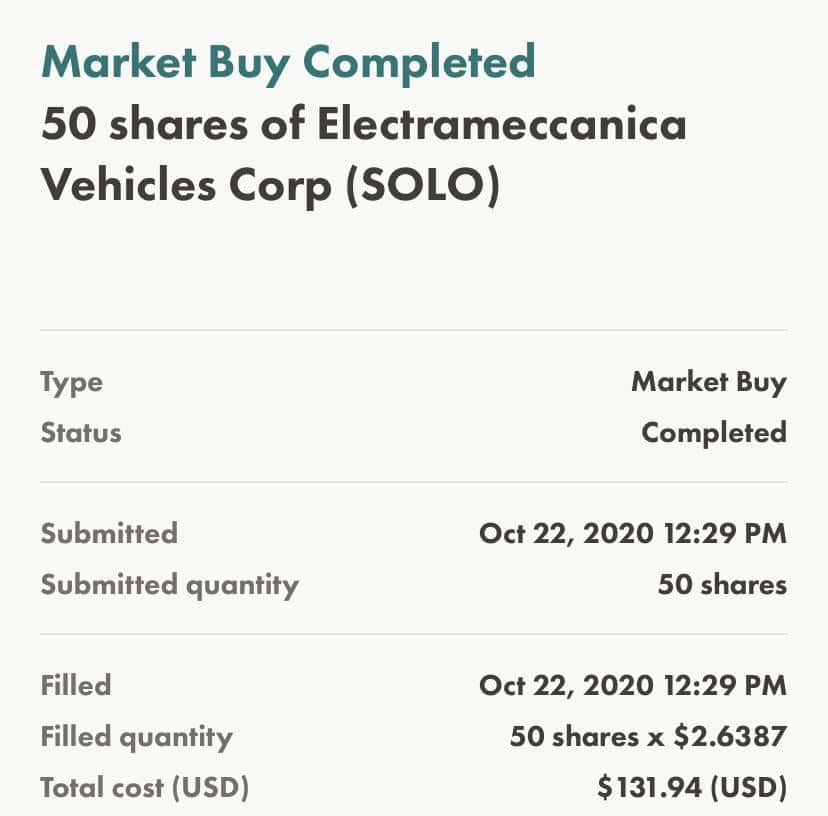

I invested in a few EV penny stocks which were predicted to run on a Biden victory as he had announced plans to fund more tax credits to consumers who buy electronic vehicles.

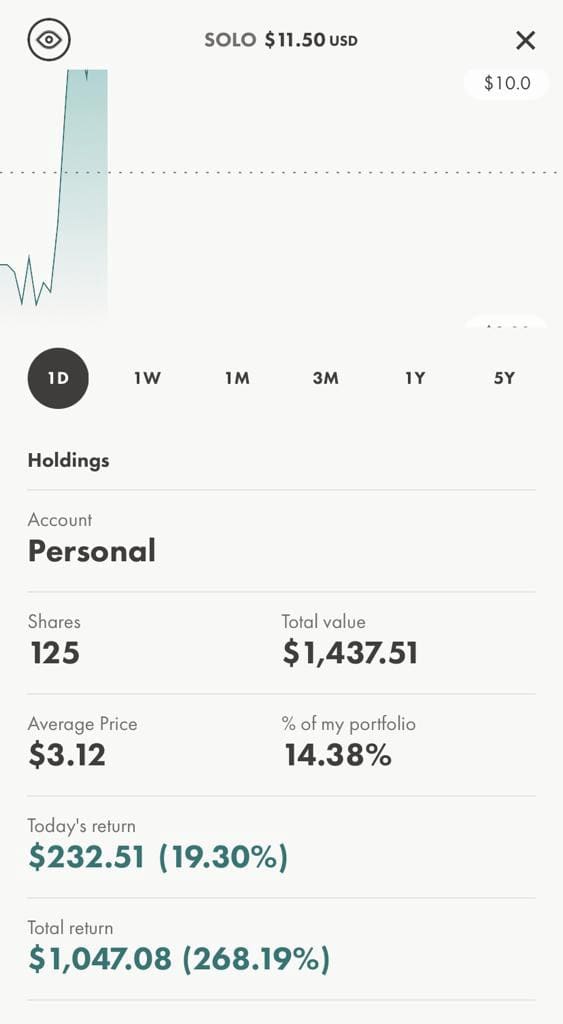

One such stock was SOLO.

As you can see from the pictures above, I kept buying it in dips and I had around 195 shares on November 12 at an average of $3.12 per share.

It began its bull run right after the elections.

On November 20, it traded briefly around $13.60 apiece. Here’s a snapshot of my holdings in SOLO when it was at $11.50

A whopping 268% return

When it comes to stock market investing, the golden advice is to take profits every now and then, as the profits that you see on screen can disappear in a minute due to something as small as a tweet from someone influential.

So, I did take some profits along the way as well. I started with 195 shares, remember.

This is just one example of how a good stock pick can do wonders in a week and this is one of the reasons why I’m in the green territory right now.

There are many other sectors like Clean Energy, Renewable Energy, Cannabis that look poised for growth in the short term as well as long term.

To summarize – do your due diligence, buy stocks in dips, take profits every now and then, stay invested in booming sectors, and reap the rewards in the long run.

Happy Investing.

Disclaimer: This article is not to be considered as investment advice.

What is Drip Network? Portfolio Snapshot Inside

Every now and then, I come across promising ideas in the crypto space and this is one among them. In this article, we are going to look into the Drip Network.

It is not a coin, but it is a network. Let’s dive deeper into what exactly is DRIP and what’s great about it.

DRIP Network is a project that provides passive income through smart contracts in Defi. It was created on the Binance Smart Chain. DRIP tokens can be bought with BEP20 BNB.

If the above definition sounded too complex to understand, let me break it down in a simple way.

DRIP Network is more like a certificate of deposit that you can buy in your bank. You invest a fixed amount for a specific period of time and in return, your bank provides you with an interest.

How much is the interest provided by DRIP Network?

It’s 1%

It is not 1% per year but 1% every freaking day. So, if you leave it untouched for a year, you are looking at 365% returns.

Sounds too good to be true, right?

We will look into how DRIP Network can provide you such massive returns.

My Journey with DRIP Network

I invested a total of $1000 into DRIP Network in the month of November 2021. I had purchased a total of 33 DRIP tokens over a few days at an average price of $30 per token.

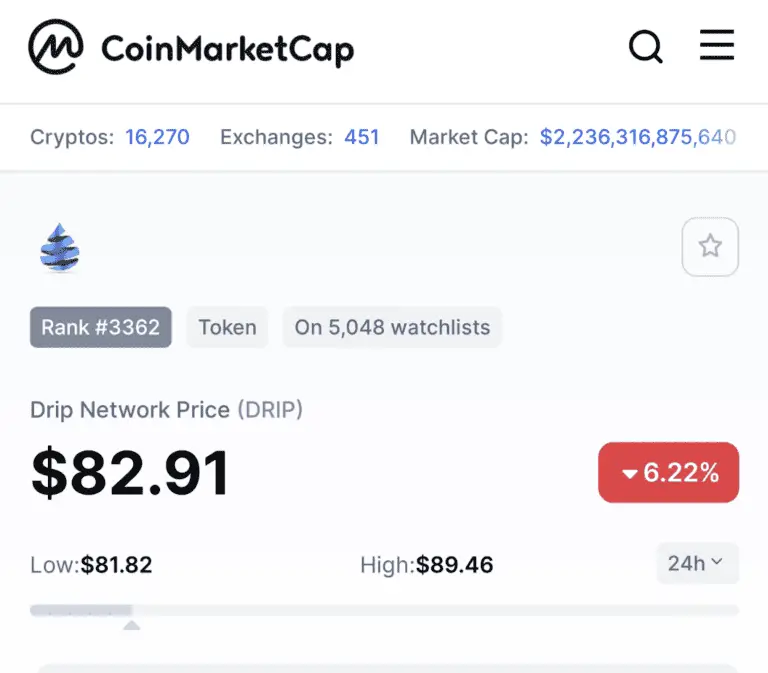

Fast forward to today (Jan 2, 2022), here’s what one DRIP token is trading at.

It has grown from $30 at the end of November 2021 to over $80 at the start of January 2022 as you can see in the 3 months chart below.

The beauty of the DRIP network is not just the 1% daily interest. It also gives you the option to reinvest the 1% so that it can get compounded.

When you reinvest your 1% daily, at the end of 1 year you are looking at a total annual percentage yield (APY) of a whopping 3678% (Fees excluded for simplicity).

Unbelievable right? Let me explain.

$1000 in DRIP Network at the end of day 1 would become $1010 (1% of $1000 is $10)

You have the option to either withdraw the $10 (1% interest) or reinvest it into DRIP Network by an option called ‘Hydrate’

When you hydrate, there is a 5% tax on compounding. This means instead of $10 being reinvested, you will be reinvesting $9.50

So, on Day 2, your $1009.50 will become $1019.59 and you can continue to repeat the process to reach the 3678% return rate in 365 days.

Whether you choose to reinvest (hydrate) or withdraw from the DRIP network, the maximum that you can withdraw in a day is 1% of what you have.

You cannot withdraw all your deposits at once. You can only withdraw 1% at once and this rule applies for everyone invested in DRIP network. This makes it sustainable as there will not be large selloffs that will affect the price of the DRIP token.

Excited to see how my DRIP dashboard looks like? Read on.

My DRIP Dashboard - Sneak peek

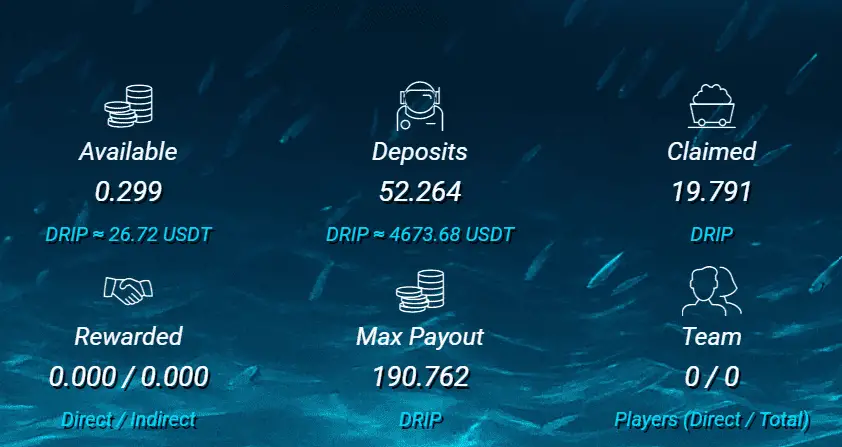

Let’s look at what each of the components in the above snapshot mean.

The first component which says ‘Available’ is the number of drip tokens that is available at that point in time for either withdrawal or reinvesting. As you can see, its 0.29 and at the end of that particular day, it will reach 0.52 which is 1% of the Deposits.

The second component – ‘Deposits’ – This shows the number of DRIP tokens that I own. It includes my purchases as well as the reinvestments of the interest that I received.

The third component – ‘Claimed’ – This shows the total number of DRIP tokens that I’ve earned since I started with DRIP network. It is the sum of all the 1% DRIP tokens that is received everyday. So, in total, I started with around 33 DRIP tokens, and I’ve earned 19.79 more tokens by compounding everyday.

The fourth component – ‘Rewarded’ – DRIP network also rewards you when you refer people to DRIP. When someone joins directly through your buddy link, a portion of their tax comes to you, and it goes under Direct. When your direct downline refers DRIP someone, you will get rewarded too and they go under Indirect. All rewards are in the form of DRIP tokens that you can choose to withdraw or reinvest. We can dive deeper about DRIP referrals in a different article.

The fifth component – ‘Max Payout’ – At any given point in time, Max payout is calculated by total deposits multiplied by 3.65

The sixth component – ‘Team’ shows the number of people who signed up using your buddy link into DRIP network. Even if you do not refer anyone, nothing changes. When you refer someone, you get more DRIP from their deposits. Just makes your DRIP portfolio bigger and bigger as everything compounds when you keep hydrating.

This is just an introduction to DRIP Network and I will be adding more content on how to purchase DRIP tokens in Canada.

Disclaimer: As always, investing in crypto or stocks comes with a set of risks. Please do your own due diligence and this article is not to be considered as financial advice.

Canadian Banks – Dividend Payment Dates 2022

Are you a fan of dividend investing?

Owning the big five Canadian banking stocks can reward you with handsome dividends every quarter. Here are the dividend dates of Canadian banks for the year 2022.

What is a dividend?

Dividends are a distribution of some of the company’s earnings to eligible shareholders. It is determined by the board of directors of the company. It is a small reward to the investors who have trusted their money into these publicly listed companies, and it comes originally from the profits.

When it comes to Canadian stocks, Canadian banks are often the best dividend payers.

Dividend Dates – Types of Dates

When it comes to dividends, you need to understand the difference between record date, ex-dividend date, payment date etc. Here we go.

Announcement Date: As the name indicates, announcement date is the date on which dividends are declared. It is also called the declaration date. It happens once the dividends are approved by the board of directors of the company.

Ex-dividend Date: The date on which dividend eligibility expires is called the Ex-dividend date. For example, if the ex-dividend date of a stock is Jan 4, 2022, then all stock holders who possess the stock as of Jan 3, 2022, are eligible for dividends. Anyone who purchases the stock on the ex-dividend date or after will not be eligible for the upcoming dividend.

Record Date: It is the cut-off date established by the company to determine which shareholders are eligible for the dividends.

Payment Date: This is the day on which the dividends are paid by the company to the shareholders’ investment account.

Let’s cut to the chase. Here are the important dividend dates for the year 2022.

BMO 2022 Dividend Payment Dates

BMO Financial group is the longest running dividend paying company in Canada. Yes, you read that right. Its dividend policy is structured in a way to pay 40% to 50% of its earnings in dividends to shareholders over time.

Let’s look at the dividend payment dates of BMO Financial Group for the year 2022. As always, record and payment dates are subject to approval by the Board of Directors.

Common Shares Record Dates | Common Shares Payment Dates |

February 1, 2022 | February 28, 2022 |

May 2, 2022 | May 26, 2022 |

August 2, 2022 | August 26, 2022 |

November 1, 2022 | November 28, 2022 |

Bank of Montreal Dividend Frequency : Quarterly

Last Dividend Amount: $1.06

Dividend Yield: 3.92%

Dividend Reinvestment Plan : Available

CIBC 2022 Dividend Payment Dates

Canadian Imperial Bank of Commerce (CIBC) has a market cap of over 65 billion C$ and has an attractive dividend yield of 4.38%.

The dates in the table below are subject to CIBC’s Board of Directors.

Record date | Payment date |

March 28, 2022 | April 28, 2022 |

June 28, 2022 | July 28, 2022 |

September 28, 2022 | October 28, 2022 |

Canadian Imperial Bank of Commerce Dividend Frequency : Quarterly

Last Dividend Amount: $1.46

Dividend Yield: 4.38%

Dividend Reinvestment Plan : Available

TD Bank 2022 Dividend Payment Dates

Record Date | Payment Date |

Jan 9, 2022 | Jan 30, 2022 |

Toronto Dominion Bank Dividend Frequency : Quarterly

Last Dividend Amount: $0.79

Dividend Yield: 3.70%

Dividend Reinvestment Plan : Available

RBC 2022 Dividend Payment Dates

Ex-Dividend Date | Payment Date |

25 January 2022 | 24 February 2022 |

27 April 2022 | 24 May 2022 |

25 July 2022 | 24 August 2022 |

25 October 2022 | 24 Nov 2022 |

Royal Bank of Canada Bank Dividend Frequency : Quarterly

Last Dividend Amount: $1.08

Dividend Yield: 3.2%

Dividend Reinvestment Plan : Available

Scotiabank 2022 Dividend Payment Dates

Scotiabank has raised its dividend rates in 43 out of the last 45 years. It has got a consistent record of paying dividends to its shareholders ever since its first dividend payout in July 1833.

Ex-Dividend Date | Payment Date |

31 December 2021 | 27 January 2022 |

05 April 2022 | 28 April 2022 |

05 August 2022 | 28 August 2022 |

Bank of Nova Scotia Dividend Frequency : Quarterly

Last Dividend Amount: $0.90

Dividend Yield: 4.46%

Dividend Reinvestment Plan : Available

If you are planning to get started with these dividend stocks, head to Wealthsimple Trade and open your account today. You will get 2 free stocks that could be worth over thousands of $.

Wealthsimple Trade – Common Questions Answered

I have been using Wealthsimple Trade for around 2 years now and I absolutely love the app. If you are new to stock trading on Wealthsimple Trade, you might have more than a few questions.

Here are some of the most commonly asked questions about Wealthsimple Trade.

How much does Wealthsimple charge per trade?

A grand total of $0. Wealthsimple Trade is the first and only commission free trading platform in Canada.

How to trade options on Wealthsimple Trade?

As of now (Dec 2021), Wealthsimple Trade does not allow options trading. Must be in the works and when it drops, it should be awesome. You can buy stocks, etfs and even do fractional investing but not options & warrants.

How to withdraw money from Wealthsimple Trade?

Short story short, in a few clicks.

Step 1: Press the ‘Move’ button at the bottom

Step 2: Select ‘Withdraw Funds’

Step 3: It will ask ‘Which account do you want to withdraw from?’. Select the Account type and press continue.

Step 4: Enter the amount that you would like to withdraw

Step 5: Select the account to which the withdrawal has to be sent.

Step 6: Verify and submit withdrawal

You will receive the funds in your account in 2 to 3 business days.

How do you receive dividends on Wealthsimple Trade?

You will automatically receive dividends from eligible stocks that you own. You do not need to do anything. If you want to find your dividends inside the mobile app, follow the steps below.

a)Login to the Wealthsimple Trade App

- b) Press ‘More’ and select ‘Activity’

- c) Press ‘Filter’ and select ‘Dividends’ under Activity type. The default selection would be ‘All’. Press ‘Done’

- d) You will see all your received dividends

Where do dividends go on Wealthsimple Trade? Is it reinvested?

Currently Wealthsimple Trade does not have a dividend reinvestment program. Your dividends go straight to your cash available to trade.

How long does deposits on Wealthsimple Trade take?

If you are a premium user, you pay $3 per month for the plan. It comes with Instant Deposits up to $5000

Does Wealthsimple Trade have a Desktop App?

Although Wealthsimple Trade launched initially as a Mobile only app, it also has a desktop app right now.

How safe is Wealthsimple Trade?

Short answer. Really Safe. When you buy a stock or an etf using Wealthsimple Trade, it is under your name. The underlying security is owned by you. Wealthsimple Trade plays the middle man here.

Still on the fence? Wealthsimple Trade is a division of Canadian Shareowner Investments Inc which is a member of IIROC (Investment Industry Regulatory Organization of Canada).

All the members of IIROC are part of Canadian Investor Protection Fund (CIPF). In case a member of CIPF becomes bankrupt or insolvent, your investment funds are protected up to $1000000.

So, unless you have invested more than a million dollars on Wealthsimple Trade, you need not worry. They are the leaders in the Canada and as of 2021, they manage over C$15B in assets.

Who owns Wealthsimple Trade?

Wealthsimple was founded by Michael Katchen in 2014. Wealthsimple is primarily owned by Power Corporation indirectly at 77.4% through their investments into the company.

Wealthsimple recently raised $610M at a valuation of $4B in May 2021.

How to refer my friends to Wealthsimple Trade?

Press the ‘Gift’ icon on the top right corner.

Press ‘Invite friends’ and choose any of the apps on your phone to text your friends with a referral URL.

When your friends sign up using your link, they will get two free stocks to trade.

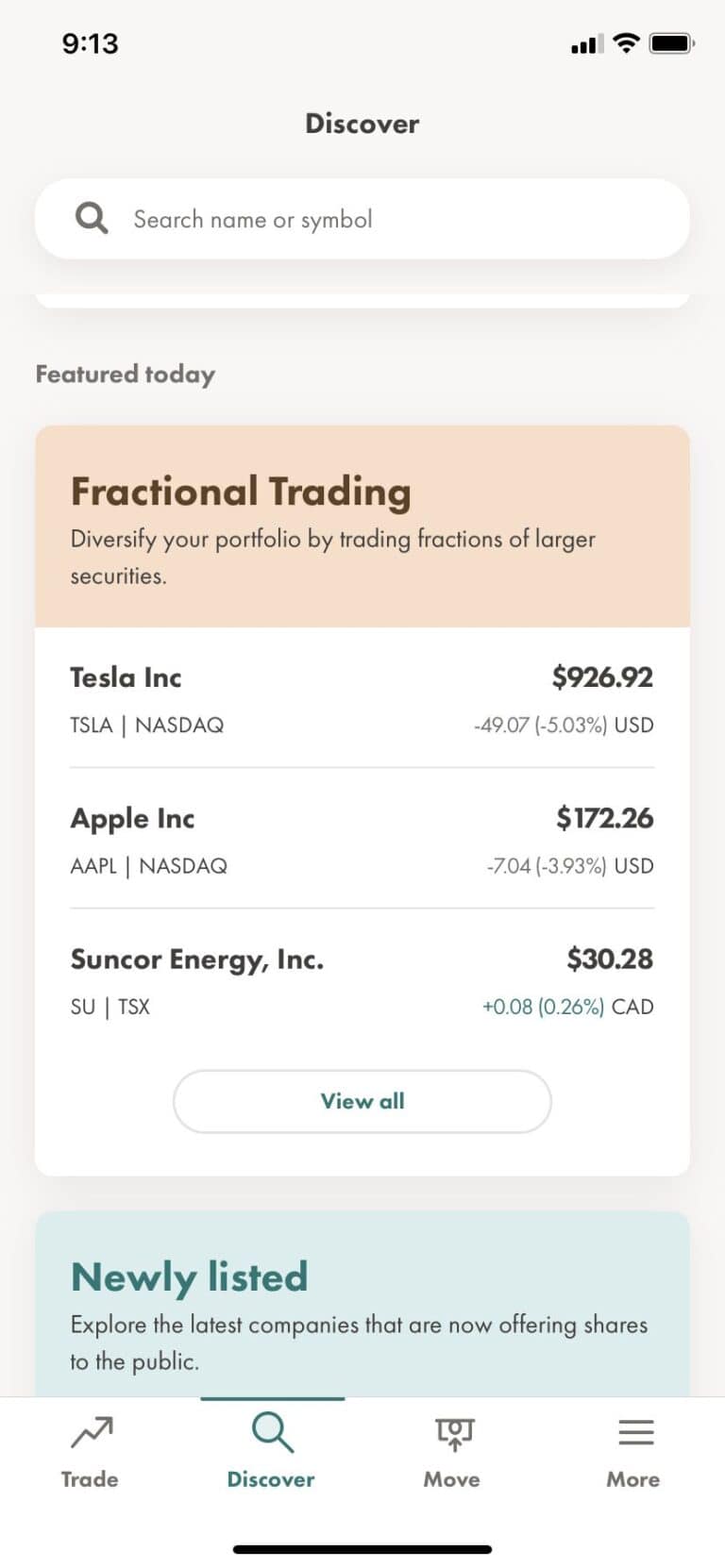

Does Wealthsimple Trade allow fractional trading?

Yes. You can buy fractional shares of more than 240 companies on Wealthsimple Trade. You can read all about it here.

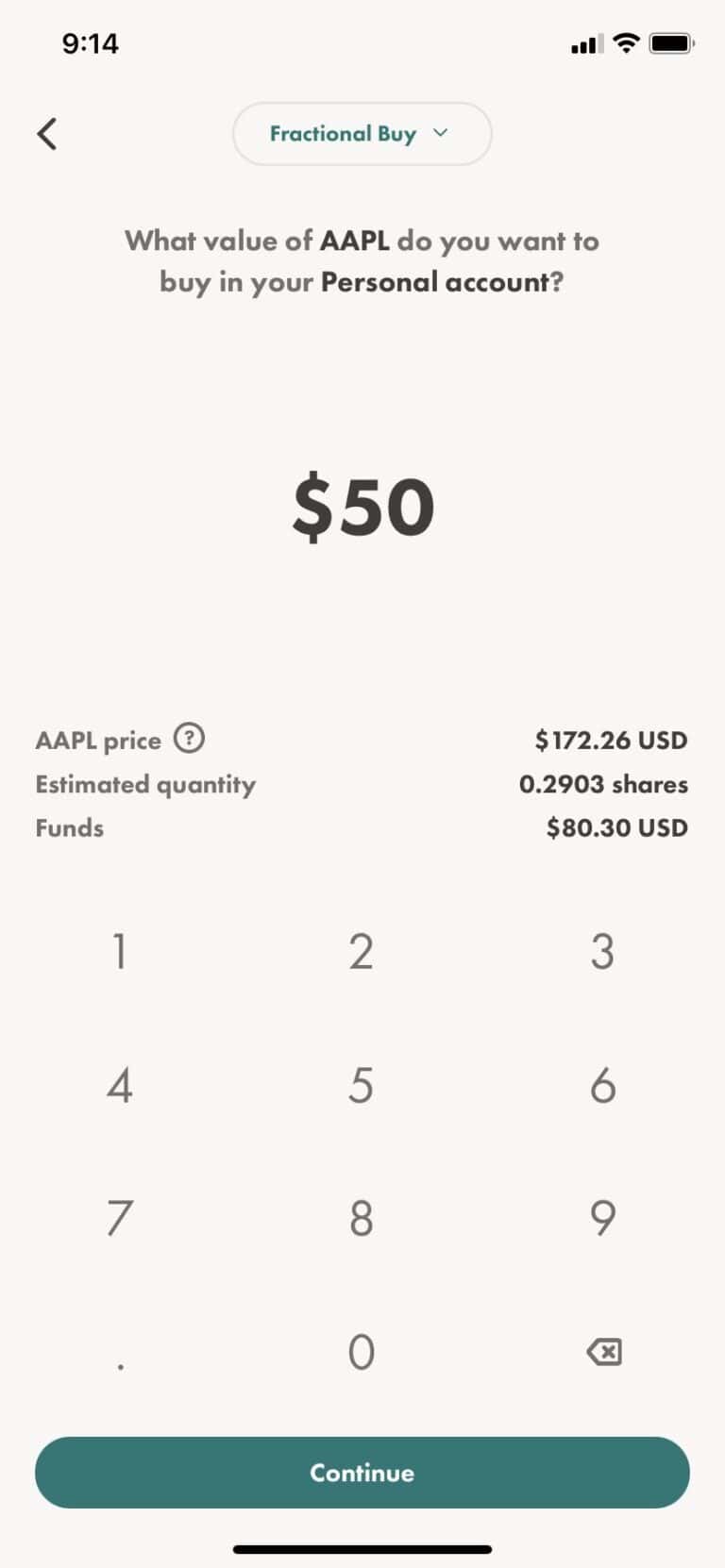

How to buy Fractional Shares on Wealthsimple Trade?

Let’s say you wanted to invest $100 into Apple every month. Apple currently trades at $178 a share. In a world without fractional trading, you might have to wait two months to get 1 share of Apple by paying whatever is the current price on the day of purchase.

Enter Fractional Trading. Want to invest $100 into Apple today? No sweat. Pay $100 and get whatever fraction of a share of Apple you can get for $100 today.

It is more like paying for a slice of pizza than the whole pizza itself.

Is Fractional Trading available in Canada?

Up until fall of 2021, Canada didn’t have an app that allowed investors like you and me to do fractional trading. Everything changed once Wealthsimple Trade introduced Fractional Trading.

With Wealthsimple Trade app, you can buy fraction of a share for as low as $1.

Do you want to invest in Tesla? Start with just $1 or $10 or $100 depending on your budgets.

Are you impressed by the massive Amazon Empire? Own a piece of the magnus opus stock trading at $3400 USD for as low as $1

Wealthsimple Trade makes it easier for retail investors like you and me to invest in big companies like Tesla, Google, Microsoft, Amazon etc.

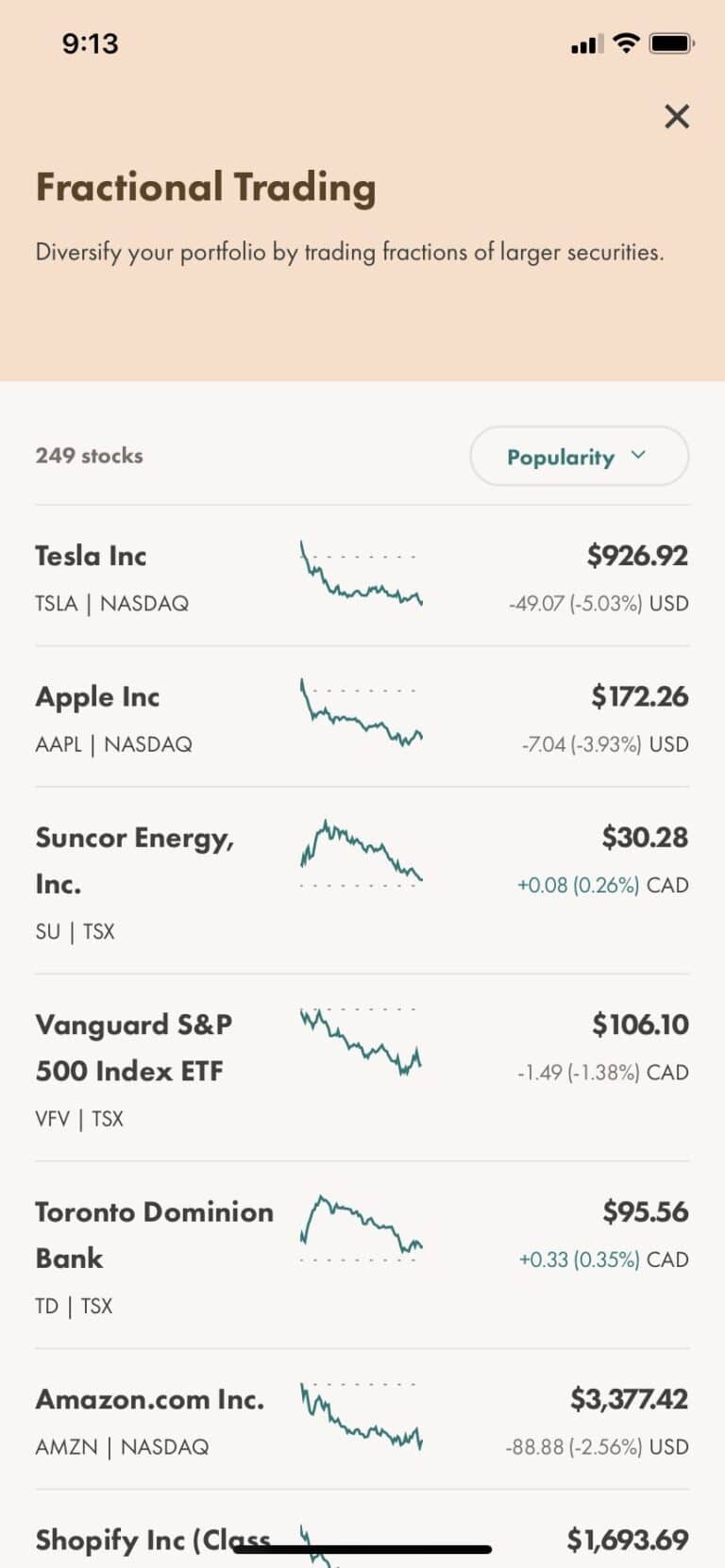

How many companies on Wealthsimple Trade offer Fractional Trading?

As of Dec 2021, there are 249 stocks that are available on Fractional Trading, Pretty impressive. It is now way easier to diversify your portfolio depending on your interests and convictions.

This list will grow bigger and bigger in the days to come.

What’s more? There are many ETFs like Vanguard S&P 500 Index ETF, ARK Investment Management LLC Innovation ETF, Vanguard Total Stock Market ETF that offer fractional trading on Wealthsimple Trade too.

So, if you are more of an ETF person, you are covered too. You can invest as low as $1 into any of the stocks and ETFs listed under Fractional Trading on Wealthsimple Trade.

How to buy Fractional Shares on Wealthsimple Trade?

Step 1: Sign in to your Wealthsimple Trade App

Step 2: Press ‘Discover’ at the bottom

Step 3: Press “View All” to check all the stocks that are available under Fractional Trading. You will be taken to this view.

Step 4: Let’s say you would like to buy $50 worth of Apple shares. Click ‘Apple’

Check the small fractional pie symbol right next to Apple Inc. That signifies that this stock can be fractionally traded.

So, any stock with this symbol next to it can be fractionally traded. Let’s get back to business.

Step 5: Enter $50 and press submit.

You will be able to see the estimated quantity of shares that you can get for $50. As the screen says, your $50 would get 0.29 shares of Apple Inc.

Press ‘Continue’ and ‘Confirm Order’ on the next screen and you are now a proud owner of a fraction of an Apple share.

Five Advantages of Fractional Trading

- Dollar Cost Averaging

Let’s say you set aside $250 for investing on your biweekly paycheck and you want to invest in Tesla, you would have to wait for more than 2 months to accumulate $1000 to buy 1 share of Tesla. This is assuming that Tesla’s shares trade at $1000 a piece.

What if it goes to $1500? (Thanks to a tweet by you-know-who)

With fractional trading, you can buy $250 worth of Tesla stock every 2 weeks as per your plan. If the price of the stock goes up or down, your costs are averaged due to dollar cost averaging.

2. Same Ownership Benefits

Even though you own a fraction of a share, you have the same ownership rights as someone who has a whole share (like 1 or 2 or 100 shares). You can sell at your convenience. And if the stock pays dividends, you will get your dividend too.

The $ value of the dividend will be proportional to the fraction of the stock that you own. Stock split / Reverse split – everything will be applied proportionately. That’s the beauty of fractional trading.

3. Time in the Market

Seasoned investors will always vouch for time in the market vs timing the market. You can never accurately time the market. Consider yourself lucky if you were able to time the market once or twice.

Fractional trading allows you to accumulate a sizeable portfolio of great stocks over time irrespective of how much they trade for.

4. Diversification

This is one of biggest advantages. You have heard it before. “Never put all your eggs in one basket”. Fractional trading allows you to invest in market leaders in every sector.

Electronics – Apple

Electric Vehicles – Tesla

Software – Microsoft

Social Networking – Facebook

E-Commerce – Amazon

Entertainment – Netflix

If you would like to invest $100 every month into each of these companies, it is possible.

If not for fractional trading, you will have to set aside thousands of dollars in order to be able to own 1 full share of some of these companies. I am not saying that’s hard.

It’s definitely possible and we will get there but until then, fractional trading is a great way to start.

5. Democratizing the Stock Market

Ever since the origin of stock trading apps that made investing paperless to start and required just a few clicks to buy and sell stocks, millions of millennials started their investing journey.

Fractional trading made it even easier for the newest class of retail investors to get their share of their pie in the stock market.

Disadvantages of Fractional Trading

Transaction Fees

When it comes to Wealthsimple Trade, all trades are free. So, no matter how many trades you make per month, it is free.

Of course, there is an exchange fee when CAD is converted to USD, but that might change when they launch Plus plans in January 2022. It comes with USD accounts so exchange CAD to USD once and you can buy US stocks with your US account.

So technically if you are in Canada, Wealthsimple Trade is your only option for fractional trading and since there is no transaction fees, this disadvantage doesn’t apply. Currently Questrade does not offer fractional trading.

Are you new to stock investing? Here’s why Wealthsimple Trade is the perfect app to get started. Hope this article on buying fractional shares on Wealthsimple Trade was useful. Drop your questions in the comments and see you there.

Best Stock Trading App in Canada for Beginners

If you are new to the world of stock investing, you need an app that makes it easier to buy and sell stocks. It should also be easier to setup, faster deposits, and withdrawals (the profits).

Whenever you are learning to invest in stocks for the first time, your experience as a user goes a long way in how you trade stocks. So, if it’s an easy-peasy experience, you will learn faster and become a pro in no time.

I began investing through Wealthsimple Trade and I still use it as my primary stock trading app. I’ve used other platforms and if I were to begin my investing journey again today, I would still choose Wealthsimple Trade.

Here are seven reasons why Wealthsimple Trade should be your top choice as a beginner investor in Canada.

1.Commission Free Trading

You must have seen Youtubers in the US raving about Robinhood, Webull etc as they are the leading commission free trading apps in the US. Unfortunately, they are not available for Canadian investors like you and me.

Thankfully, we have Wealthsimple Trade, Canada’s only commission free trading app.

You can buy both Canadian stocks, US stocks and ETFs that are listed on major exchanges like NASDAQ, NYSE and TSX

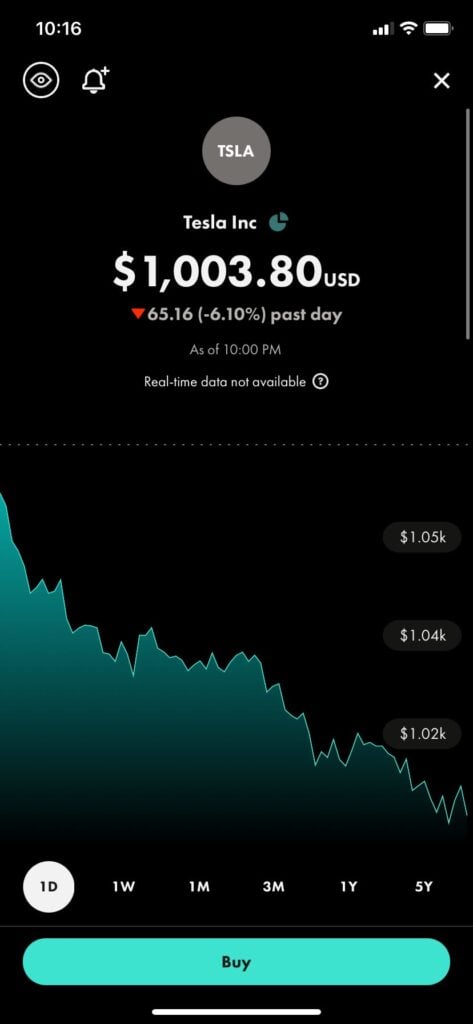

2. Fractional Investing

Fractional Trading or Fractional Investing is a type of stock trading in which you can buy just a fraction of a share of any company.

If you are a big fan of Elon Musk and if you would like to purchase a share of TESLA, you would have to spend $1003.80 as of this writing.

However, Wealthsimple Trade is the only Canadian app that allows you to buy a fraction of a share of TESLA for as little as $1.

This means that if you want to invest a set amount of $100 every month into a growth stock like Tesla or Apple, it is possible with Wealthsimple Trade. Depending on how much the stock is trading for on that particular day, you would receive a fraction of the share for the amount you invest.

What’s more? If the stock pays out dividends, you will receive dividends proportional to the number of shares that you own.

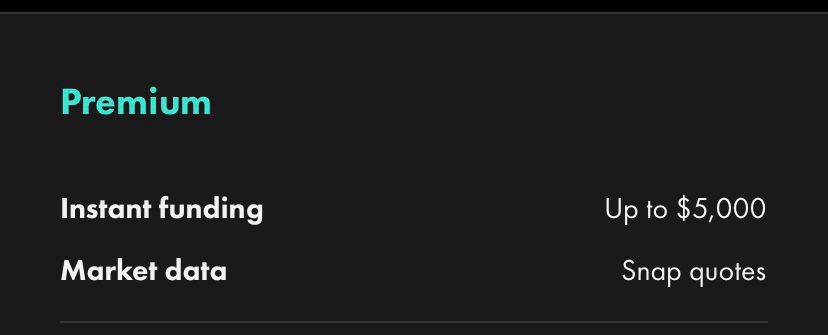

3. Premium Subscription at just $3 per month

For just the price of an Iced Capp at Tim Horton’s, Wealthsimple Trade offers you their premium subscription. It comes with two amazing super powers.

Instant funding

can really save you a lot of money and time. Let’s say there is a big dip in

the stock market during the market hours due to an external catalyst, you can

take advantage of the red day by buying more of the stocks you believe in

almost instantly.

In earlier days of

Wealthsimple Trade, it used to take 1 to 2 business days for the deposit from

the bank to hit your trading account.

A lot can happen

in a couple of days. So instant deposits are really a godsend, and it is upto

$5000 which makes it amazing.

Snap quotes are

live quotes at just a click of a button. It’s a new add-on for premium users

and it is definitely worth upgrading as the premium subscription comes at just

$3 per month.

For normal users,

quotes are delayed by 15 minutes, and you will have to use a different app like

Yahoo finance to check the live prices. Instead upgrade to premium and use just

1 app.

4. Ease of Use

In terms of ease

of use, Wealthsimple Trade is simply the best stock trading app in Canada.

Having used both Wealthsimple Trade & Questrade mobile apps, I would pick

WS Trade any day.

The app is

designed thoughtfully, and it is really clean.

No clutter and everything will be pretty easy to navigate from day 1.

In some ways, they

are similar to Apple. Features take a while to come but when they arrive, they

are the best ones and they beat everything else hands down.

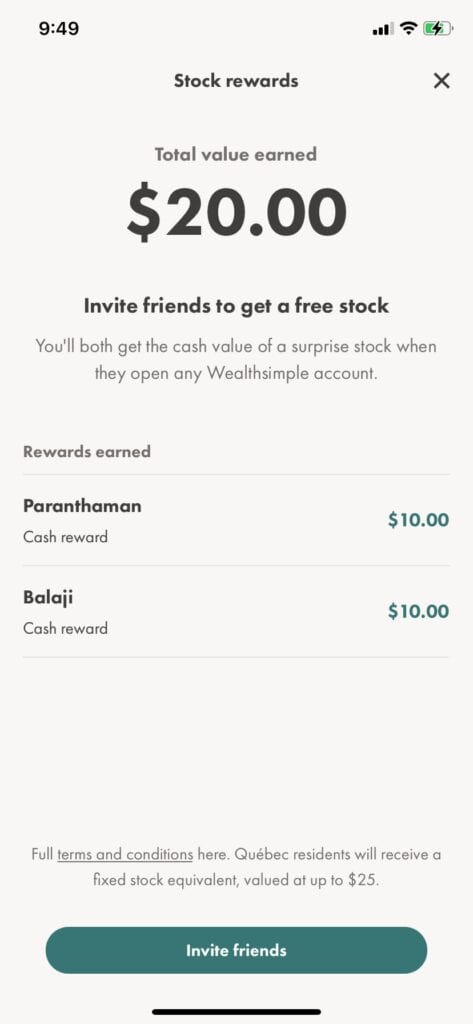

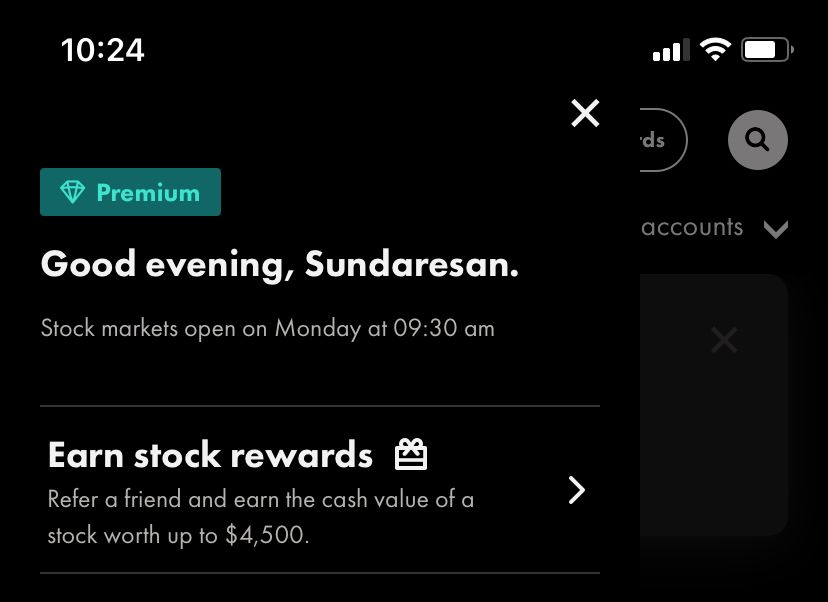

- Stock Rewards Program

Wealthsimple Trade

has a referral program that can reward you with cash value of stock that is

worth up to $4500. Yes, you read that right.

Imagine referring

your friend or your spouse to get started with investing using Wealthsimple

Trade and you are rewarded with a cash value of 1 share of Amazon.

That’s $3444 as of

today.

The best part is

the surprise element. It could be small, or it could be huge like Amazon, Tesla,

Shopify, or Google as it is randomly chosen.

And this surprise gift is not just for you, your friend’s first stock is on Wealthsimple Trade as well.

6. Learn as you

grow your investment portfolio

If you are new to stock

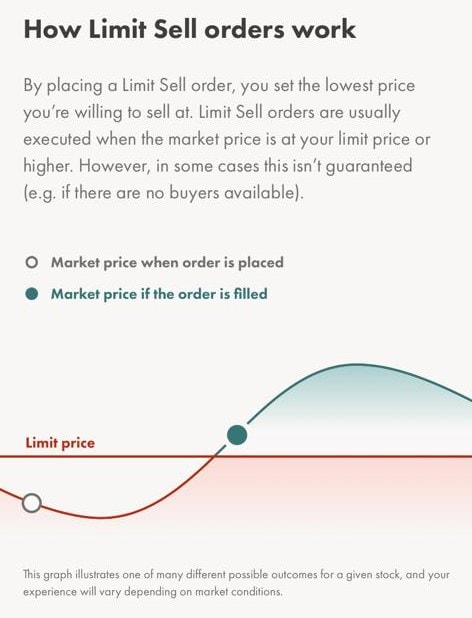

investing, Wealthsimple Trade will have constant pointers on how specific order

types like limit sells, limit buys and others work.

Also, when there

is a highly volatile stock as a result of a short squeeze like GME or AMC from early

this year, Wealthsimple Trade will also trigger a cautionary alert before you execute

the buy or sell order.

7. Upcoming Features

Every few months,

Wealthsimple Trade comes up with exciting features. Exclusive features like USD

accounts, unlimited price alerts are coming soon on Wealthsimple plus plan.

It starts at

$10 at month

One of the biggest

pet peeves of Wealthsimple Trade users is the currency exchange fees every time

an order is processed. For every buy and every sell, Wealthsimple Trade does

the conversion (for a 1.5% foreign exchange fee) and that’s how they make their

money as all trades are commission-free.

Once the plus plan

rolls out, you can convert a tidy sum of CAD to fund your USD account. You will

incur a 1.5% foreign exchange fee for that one transaction.

And as long as you

do your trades using your US account, buying, and selling US stocks should be

free. No currency exchange fee, whatso ever. Do as many trades as you like. It’s

all free.

Let’s say you do

10 trades a month on US Stocks, you are only looking at the $10 monthly fee.

Compare that to Questrade, where they charge $4.99 for all stock orders (buy or

sell). Questrade will cost you $50 compared to just $10 on Wealthsimple Trade.

We will know more

when these features drop in 2022.

And for all the

above reasons, Wealthsimple Trade is simply the best stock investing app in

Canada for beginners.