Are you a fan of dividend investing?

Owning the big five Canadian banking stocks can reward you with handsome dividends every quarter. Here are the dividend dates of Canadian banks for the year 2022.

What is a dividend?

Dividends are a distribution of some of the company’s earnings to eligible shareholders. It is determined by the board of directors of the company. It is a small reward to the investors who have trusted their money into these publicly listed companies, and it comes originally from the profits.

When it comes to Canadian stocks, Canadian banks are often the best dividend payers.

Dividend Dates – Types of Dates

When it comes to dividends, you need to understand the difference between record date, ex-dividend date, payment date etc. Here we go.

Announcement Date: As the name indicates, announcement date is the date on which dividends are declared. It is also called the declaration date. It happens once the dividends are approved by the board of directors of the company.

Ex-dividend Date: The date on which dividend eligibility expires is called the Ex-dividend date. For example, if the ex-dividend date of a stock is Jan 4, 2022, then all stock holders who possess the stock as of Jan 3, 2022, are eligible for dividends. Anyone who purchases the stock on the ex-dividend date or after will not be eligible for the upcoming dividend.

Record Date: It is the cut-off date established by the company to determine which shareholders are eligible for the dividends.

Payment Date: This is the day on which the dividends are paid by the company to the shareholders’ investment account.

Let’s cut to the chase. Here are the important dividend dates for the year 2022.

BMO 2022 Dividend Payment Dates

BMO Financial group is the longest running dividend paying company in Canada. Yes, you read that right. Its dividend policy is structured in a way to pay 40% to 50% of its earnings in dividends to shareholders over time.

Let’s look at the dividend payment dates of BMO Financial Group for the year 2022. As always, record and payment dates are subject to approval by the Board of Directors.

Common Shares Record Dates | Common Shares Payment Dates |

February 1, 2022 | February 28, 2022 |

May 2, 2022 | May 26, 2022 |

August 2, 2022 | August 26, 2022 |

November 1, 2022 | November 28, 2022 |

Bank of Montreal Dividend Frequency : Quarterly

Last Dividend Amount: $1.06

Dividend Yield: 3.92%

Dividend Reinvestment Plan : Available

CIBC 2022 Dividend Payment Dates

Canadian Imperial Bank of Commerce (CIBC) has a market cap of over 65 billion C$ and has an attractive dividend yield of 4.38%.

The dates in the table below are subject to CIBC’s Board of Directors.

Record date | Payment date |

March 28, 2022 | April 28, 2022 |

June 28, 2022 | July 28, 2022 |

September 28, 2022 | October 28, 2022 |

Canadian Imperial Bank of Commerce Dividend Frequency : Quarterly

Last Dividend Amount: $1.46

Dividend Yield: 4.38%

Dividend Reinvestment Plan : Available

TD Bank 2022 Dividend Payment Dates

Record Date | Payment Date |

Jan 9, 2022 | Jan 30, 2022 |

Toronto Dominion Bank Dividend Frequency : Quarterly

Last Dividend Amount: $0.79

Dividend Yield: 3.70%

Dividend Reinvestment Plan : Available

RBC 2022 Dividend Payment Dates

Ex-Dividend Date | Payment Date |

25 January 2022 | 24 February 2022 |

27 April 2022 | 24 May 2022 |

25 July 2022 | 24 August 2022 |

25 October 2022 | 24 Nov 2022 |

Royal Bank of Canada Bank Dividend Frequency : Quarterly

Last Dividend Amount: $1.08

Dividend Yield: 3.2%

Dividend Reinvestment Plan : Available

Scotiabank 2022 Dividend Payment Dates

Scotiabank has raised its dividend rates in 43 out of the last 45 years. It has got a consistent record of paying dividends to its shareholders ever since its first dividend payout in July 1833.

Ex-Dividend Date | Payment Date |

31 December 2021 | 27 January 2022 |

05 April 2022 | 28 April 2022 |

05 August 2022 | 28 August 2022 |

Bank of Nova Scotia Dividend Frequency : Quarterly

Last Dividend Amount: $0.90

Dividend Yield: 4.46%

Dividend Reinvestment Plan : Available

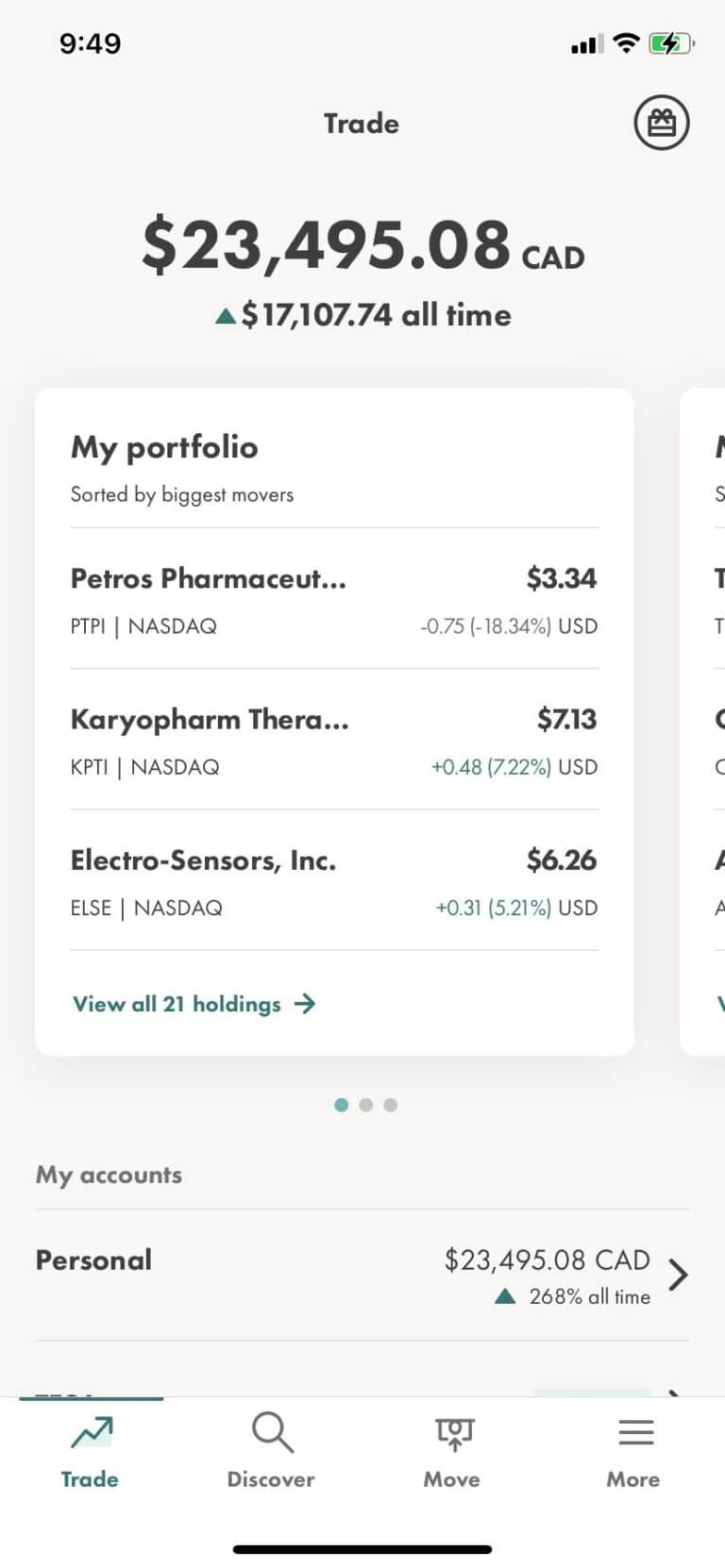

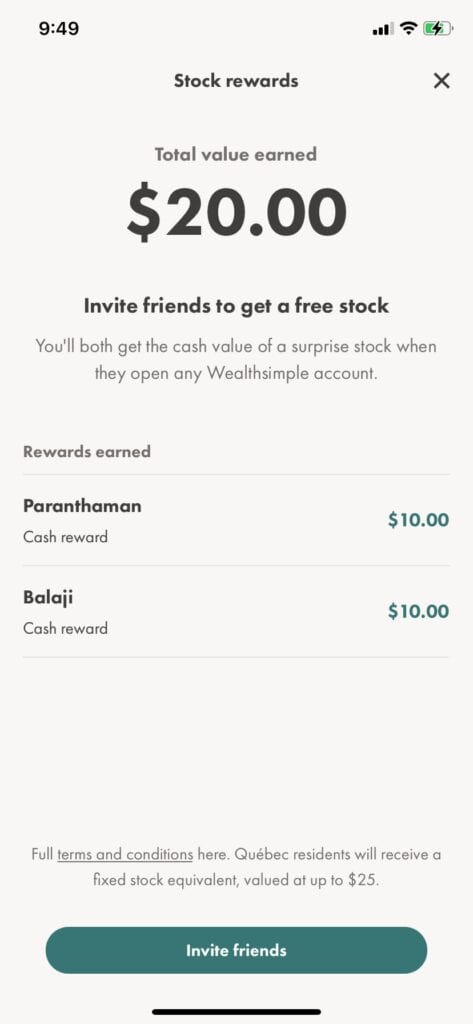

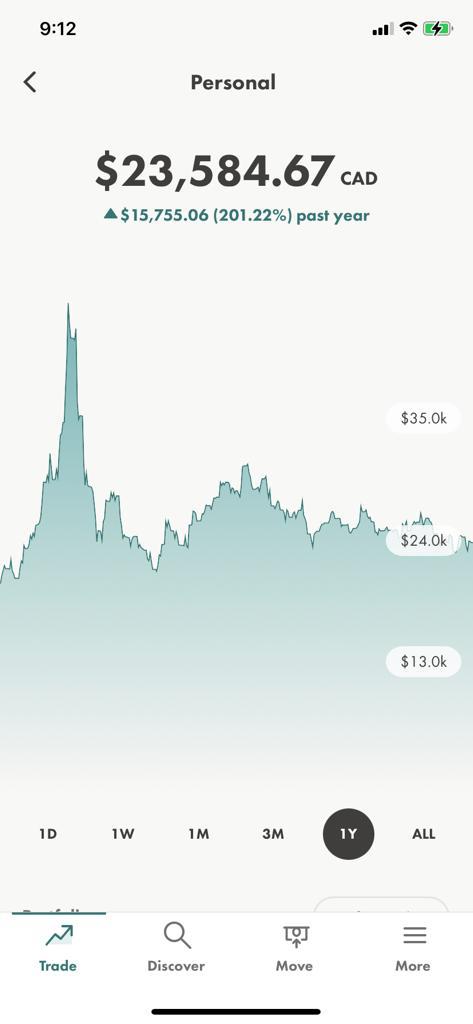

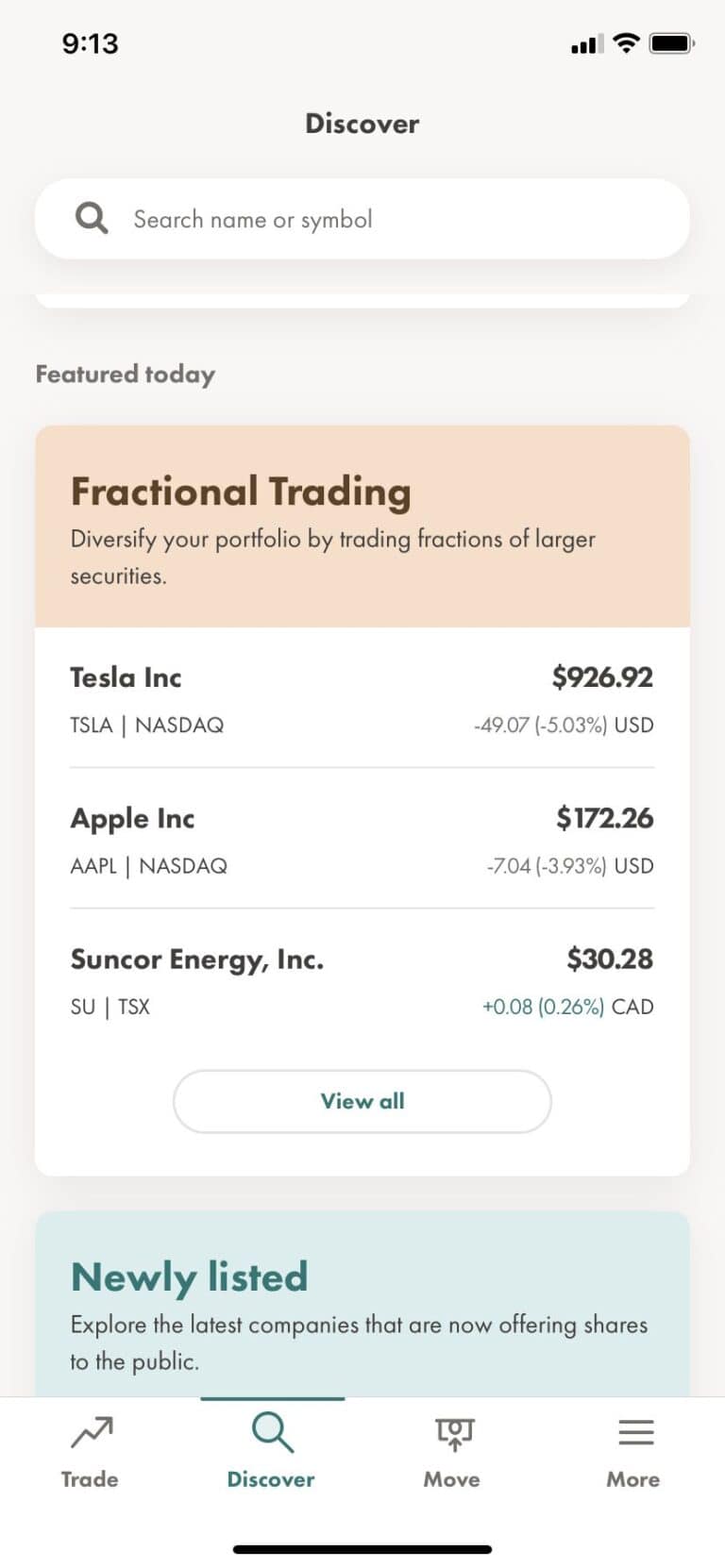

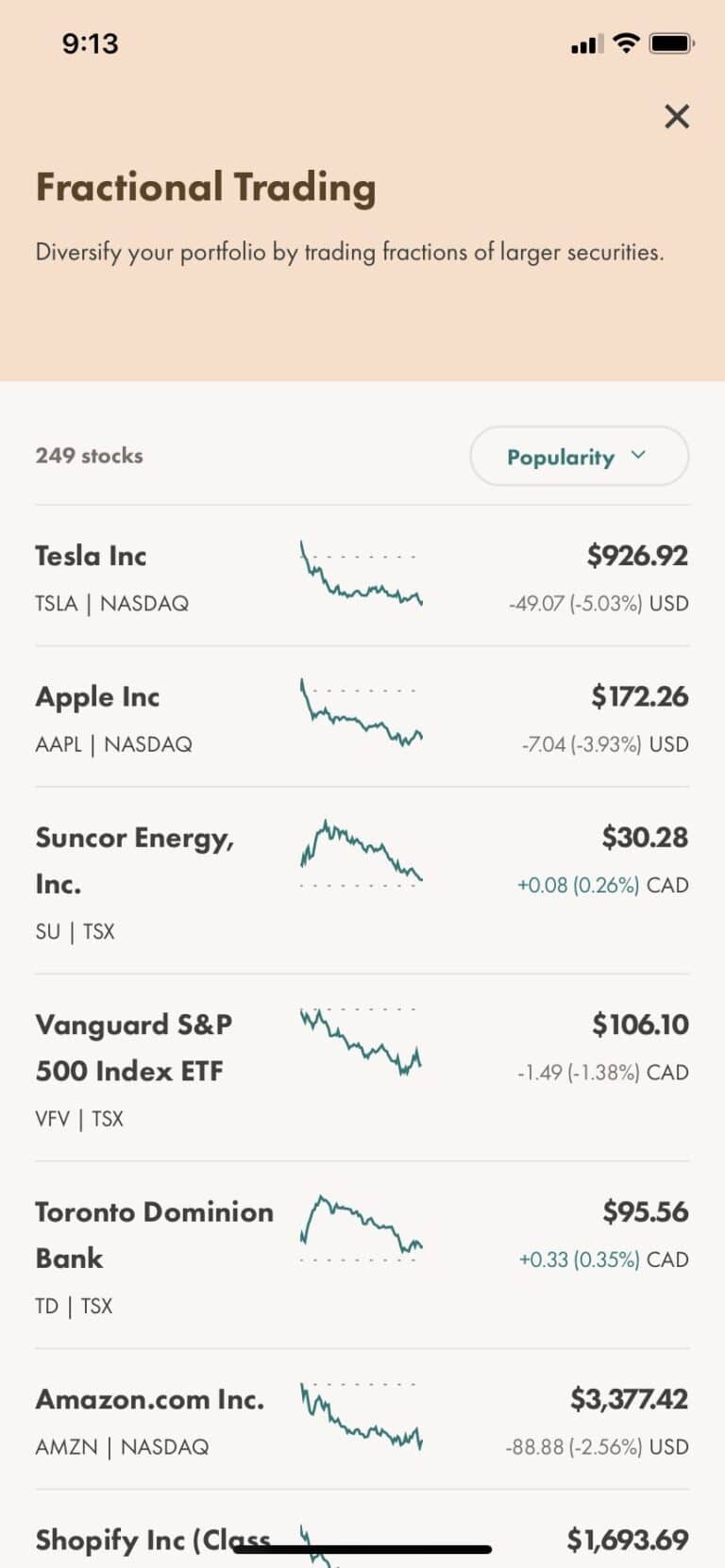

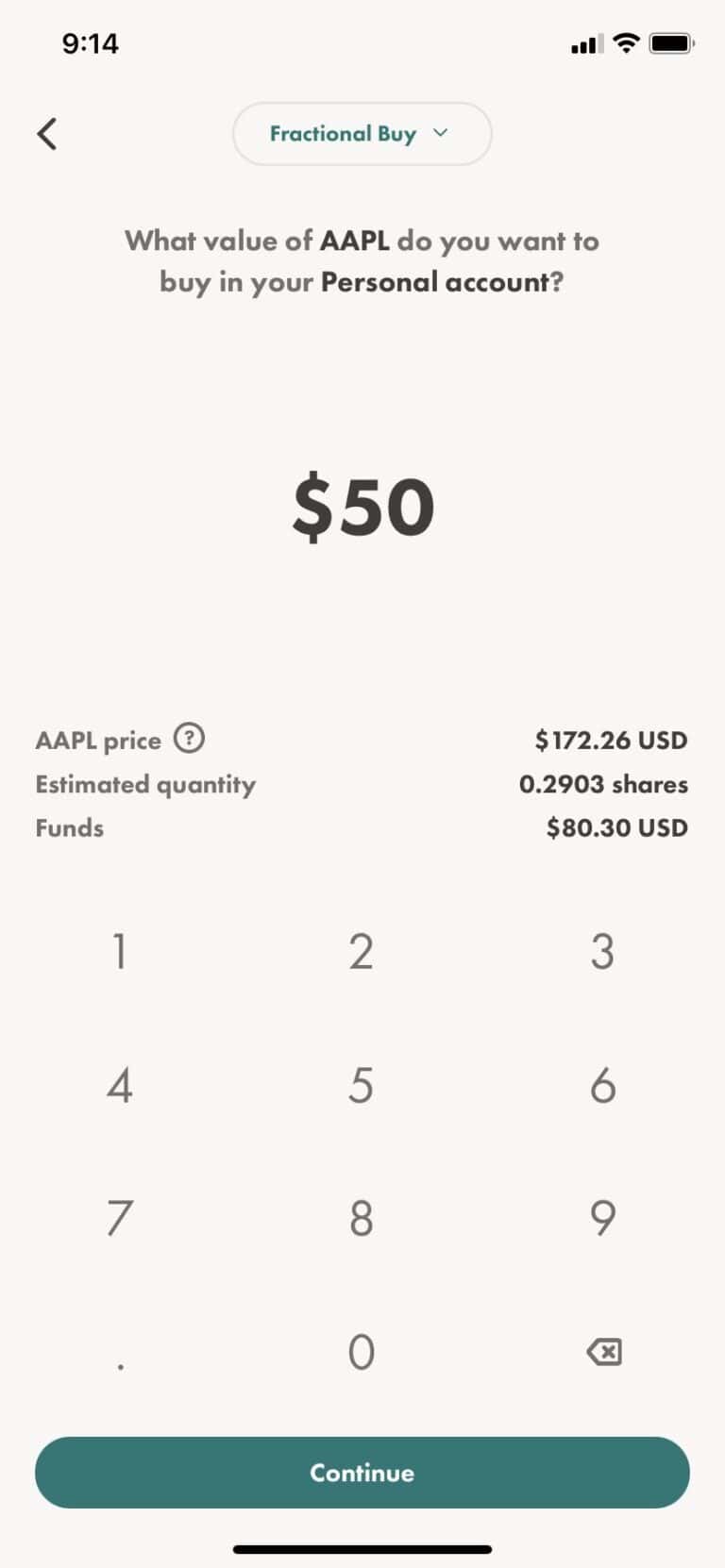

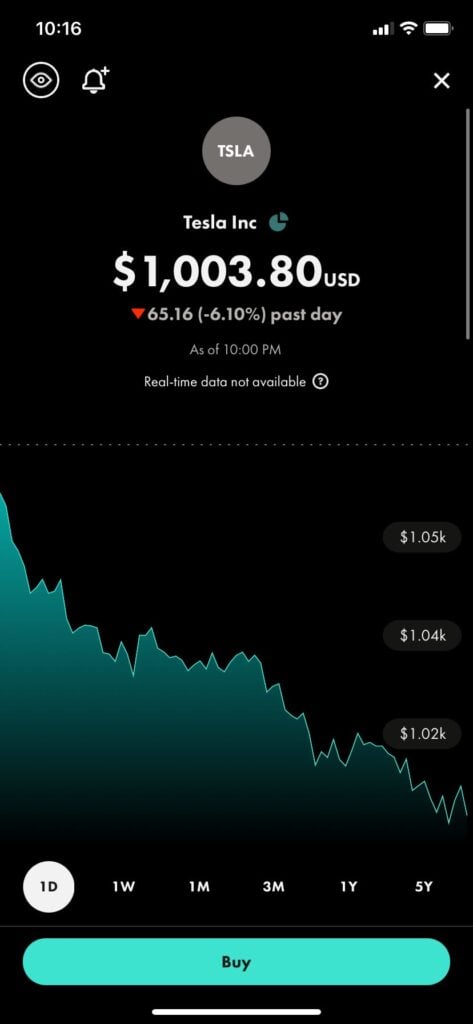

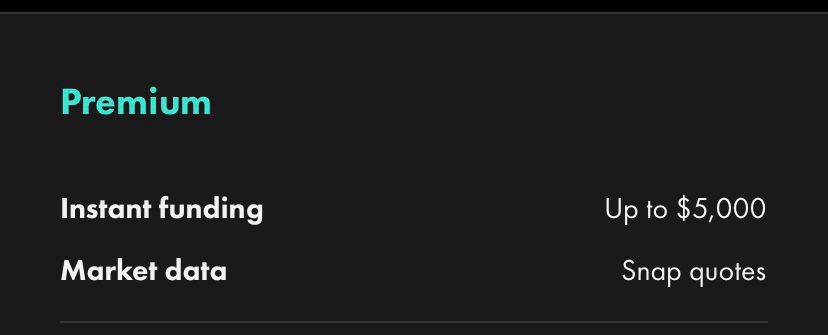

If you are planning to get started with these dividend stocks, head to Wealthsimple Trade and open your account today. You will get 2 free stocks that could be worth over thousands of $.