If you’re looking to set up a Dividend Reinvestment Plan (DRIP) on Questrade, you’re in the right place. As an investor, you may be looking for ways to maximize your returns while minimizing your costs. DRIP is a great way to do just that.

By automatically reinvesting your dividend payments, you can purchase more shares of the same stock or fund without incurring any additional trading fees. This can help you grow your portfolio over time and increase your overall return on investment.

Setting up a DRIP on Questrade is a straightforward process. You can do it online in just a few simple steps. Once you’ve set it up, you can sit back and let it do the work for you. Your dividends will automatically be reinvested, and you’ll start seeing the benefits of compound interest.

Steps to Setup DRIP on Questrade

STEP 1: Download and complete the DRIP application form

- Fill out the account number in the top right corner. If you want to set up DRIP on multiple accounts on Questrade, you have to submit one form for every account.

- Read through the terms and conditions carefully

- Fill out your name, the date, account number, and sign beside “Client signature” (E-signatures accepted)

- Check off either All eligible securities or Individual securities (based on your preferences)

- If you’ve selected individual securities, you will need to list the ticker symbol, the names of the Stocks or ETFs and the exchange they trade on below

- For mutual funds, you will need to list the fund code and the fund name

- If you’ve selected all eligible securities, any eligible, dividend-paying securities will automatically be enrolled in the DRIP once you have purchased the shares or fund units. This includes new positions bought after you’ve submitted the DRIP form.

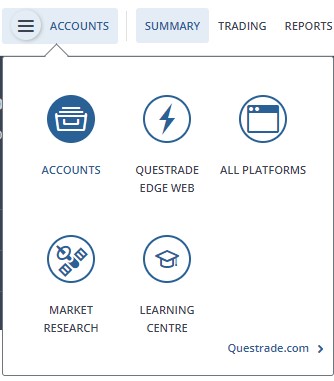

STEP 2: Log in to Questrade and go to the ‘Accounts’ section

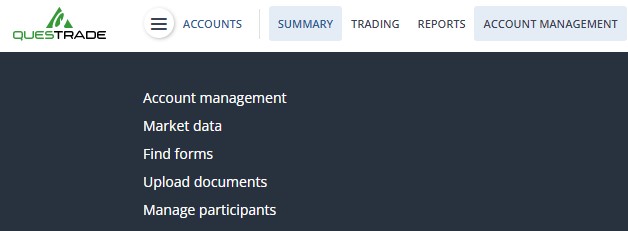

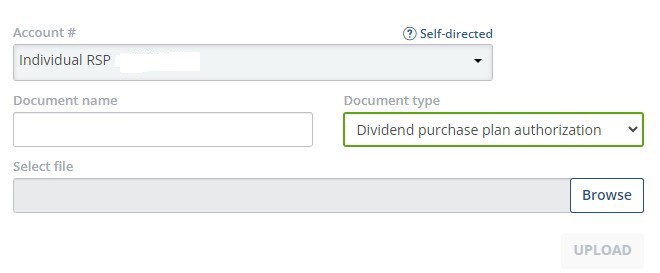

Step 3: Press ‘Account Management from the top menu and click ‘Upload documents‘

Step 4: Select the account, and set document type to ‘Dividend purchase plan authorization’, and upload the document.

DRIP on Questrade – FAQs

- What happens when the dividend amount credited is not big enough to buy a share of the underlying stock?

This is a very common scenario during the early stages of your investment journey as the dividend received will not cover the cost to purchase a new share of the same equity. In that case, the dividend $ is credited as cash to your account.

- Can Questrade buy a fraction of a share based on the dividend value?

As of July 2023, Questrade does not allow fractional trading. If the dividend is not big enough to buy a share, it will be credited as cash in the account.

- Is DRIP free on Questrade?

Yes, Dividend Reinvestment Plan (DRIP) is absolutely free on Questrade.

- What accounts are eligible for DRIP on Questrade?

TFSA, Margin, RRSP – All of these accounts are eligible for DRIP.

What is DRIP?

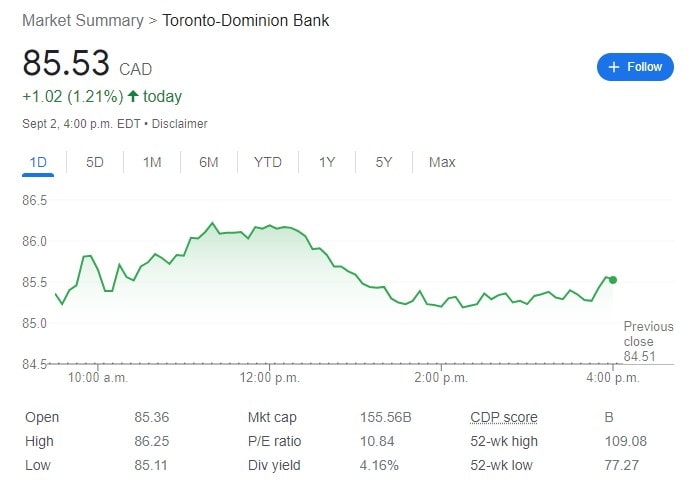

As an investor, I’m always looking for ways to maximize my returns while minimizing costs. One strategy that has been gaining popularity in recent years is the Dividend Reinvestment Plan (DRIP), which allows investors to automatically reinvest their dividends back into the underlying stock or ETF.

Essentially, a DRIP is a program offered by certain brokerages that allows investors to reinvest their dividends in additional shares of the same stock or ETF. Rather than receiving a cash payout, investors receive additional shares, which can compound over time and potentially lead to greater returns.

It’s important to note that not all securities are eligible for DRIP, and investors should check with their brokerages to see which securities are eligible before signing up for the program. Additionally, while DRIP can be a great way to save on fees and boost returns, it’s not a one-size-fits-all solution, and investors should carefully consider their own investment goals and risk tolerance before signing up.

Why Choose Questrade for DRIP?

When it comes to setting up a Dividend Reinvestment Plan (DRIP), Questrade is an excellent choice for a number of reasons. As someone who has been using Questrade for DRIP for some time now, I can confidently say that it is a reliable and user-friendly platform.

Low Commissions

One of the biggest advantages of using Questrade for DRIP is the low commissions. With Questrade, you can set up a DRIP for most stocks or funds, including Exchange Traded Funds (ETFs), without having to pay any commission fees. This can save you a significant amount of money over time, especially if you are a frequent trader.

Easy to Use

Another reason to choose Questrade for DRIP is its ease of use. Setting up a DRIP on Questrade is a straightforward process that can be completed in just a few steps as mentioned above. Once you have set up your DRIP, you can sit back and let your dividends automatically reinvest into your chosen securities.

Reliable Platform

Finally, Questrade is a reliable platform that you can trust to handle your investments. The platform is secure and has a strong reputation in the industry. Additionally, Questrade provides excellent customer service, so if you ever have any questions or concerns, you can easily get in touch with a representative who can help you out.

Overall, there are many reasons to choose Questrade for DRIP. With low commissions, ease of use, and a reliable platform, it is an excellent choice for anyone looking to set up a DRIP for their investments.