I have been using Wealthsimple Trade for around 2 years now and I absolutely love the app. If you are new to stock trading on Wealthsimple Trade, you might have more than a few questions.

Here are some of the most commonly asked questions about Wealthsimple Trade.

How much does Wealthsimple charge per trade?

A grand total of $0. Wealthsimple Trade is the first and only commission free trading platform in Canada.

How to trade options on Wealthsimple Trade?

As of now (Dec 2021), Wealthsimple Trade does not allow options trading. Must be in the works and when it drops, it should be awesome. You can buy stocks, etfs and even do fractional investing but not options & warrants.

How to withdraw money from Wealthsimple Trade?

Short story short, in a few clicks.

Step 1: Press the ‘Move’ button at the bottom

Step 2: Select ‘Withdraw Funds’

Step 3: It will ask ‘Which account do you want to withdraw from?’. Select the Account type and press continue.

Step 4: Enter the amount that you would like to withdraw

Step 5: Select the account to which the withdrawal has to be sent.

Step 6: Verify and submit withdrawal

You will receive the funds in your account in 2 to 3 business days.

How do you receive dividends on Wealthsimple Trade?

You will automatically receive dividends from eligible stocks that you own. You do not need to do anything. If you want to find your dividends inside the mobile app, follow the steps below.

a)Login to the Wealthsimple Trade App

- b) Press ‘More’ and select ‘Activity’

- c) Press ‘Filter’ and select ‘Dividends’ under Activity type. The default selection would be ‘All’. Press ‘Done’

- d) You will see all your received dividends

Where do dividends go on Wealthsimple Trade? Is it reinvested?

Currently Wealthsimple Trade does not have a dividend reinvestment program. Your dividends go straight to your cash available to trade.

How long does deposits on Wealthsimple Trade take?

If you are a premium user, you pay $3 per month for the plan. It comes with Instant Deposits up to $5000

Does Wealthsimple Trade have a Desktop App?

Although Wealthsimple Trade launched initially as a Mobile only app, it also has a desktop app right now.

How safe is Wealthsimple Trade?

Short answer. Really Safe. When you buy a stock or an etf using Wealthsimple Trade, it is under your name. The underlying security is owned by you. Wealthsimple Trade plays the middle man here.

Still on the fence? Wealthsimple Trade is a division of Canadian Shareowner Investments Inc which is a member of IIROC (Investment Industry Regulatory Organization of Canada).

All the members of IIROC are part of Canadian Investor Protection Fund (CIPF). In case a member of CIPF becomes bankrupt or insolvent, your investment funds are protected up to $1000000.

So, unless you have invested more than a million dollars on Wealthsimple Trade, you need not worry. They are the leaders in the Canada and as of 2021, they manage over C$15B in assets.

Who owns Wealthsimple Trade?

Wealthsimple was founded by Michael Katchen in 2014. Wealthsimple is primarily owned by Power Corporation indirectly at 77.4% through their investments into the company.

Wealthsimple recently raised $610M at a valuation of $4B in May 2021.

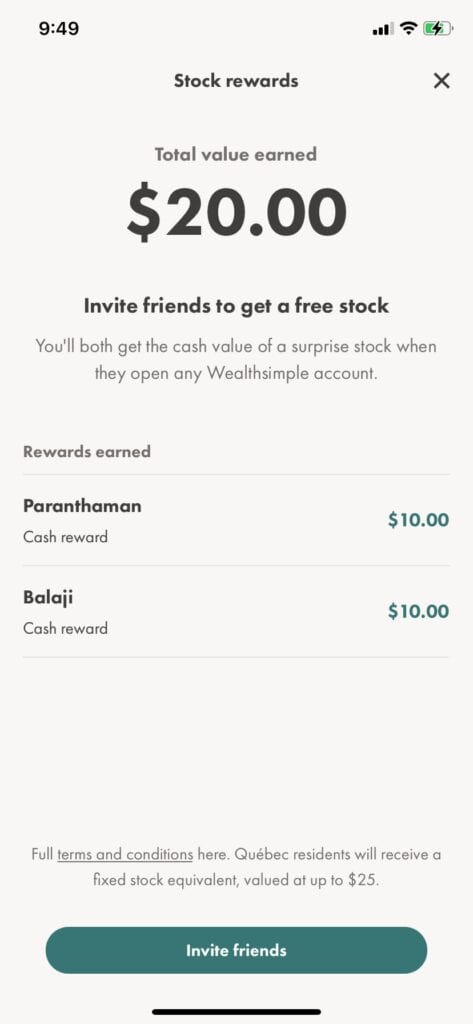

How to refer my friends to Wealthsimple Trade?

Press the ‘Gift’ icon on the top right corner.

Press ‘Invite friends’ and choose any of the apps on your phone to text your friends with a referral URL.

When your friends sign up using your link, they will get two free stocks to trade.

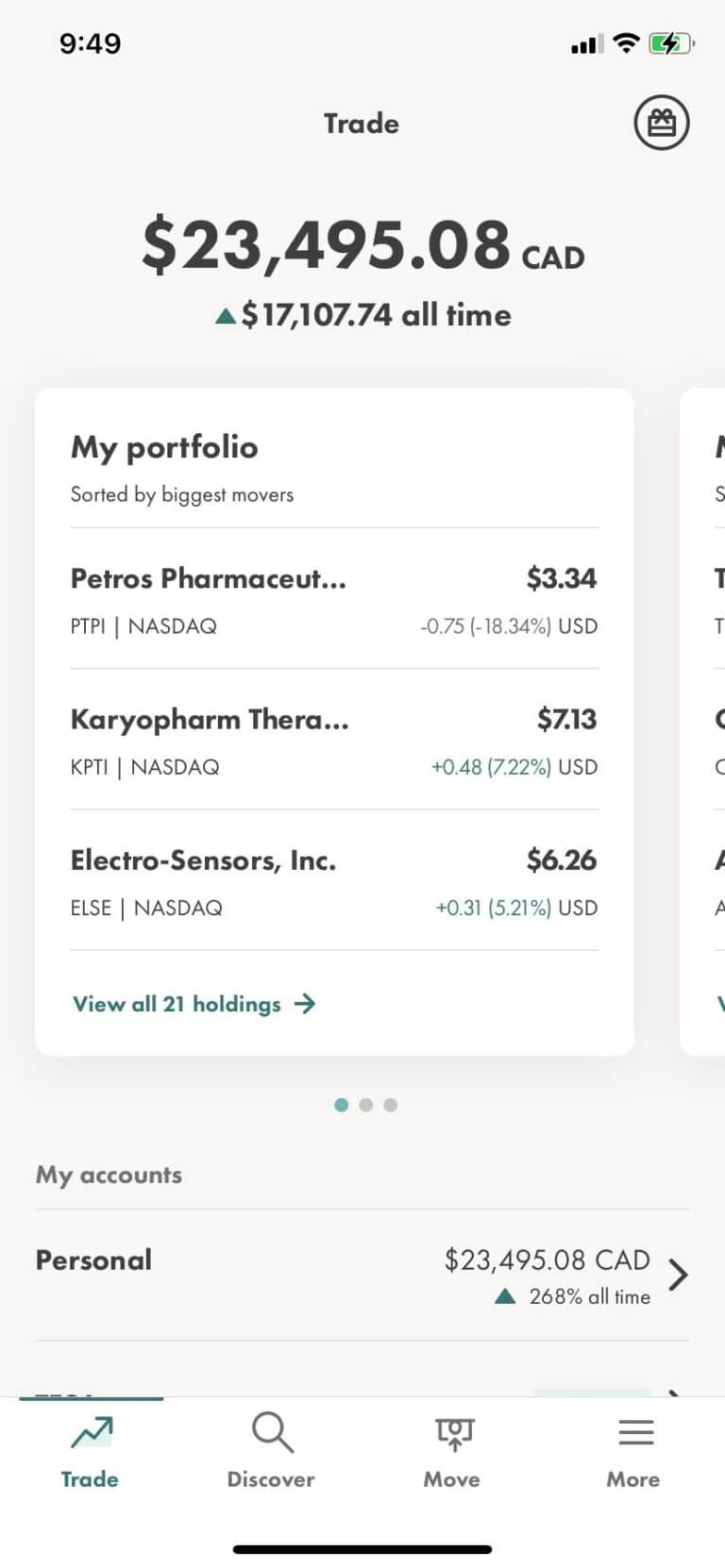

Does Wealthsimple Trade allow fractional trading?

Yes. You can buy fractional shares of more than 240 companies on Wealthsimple Trade. You can read all about it here.