How did the US Federal Elections affect my small portfolio?

The highs and lows in the stock market are often triggered by catalysts. What can be a better catalyst than the US Federal Elections?

I started investing right before the pandemic hit and I continued to invest around $1k every month since March 2020 in the US and Canadian stock markets.

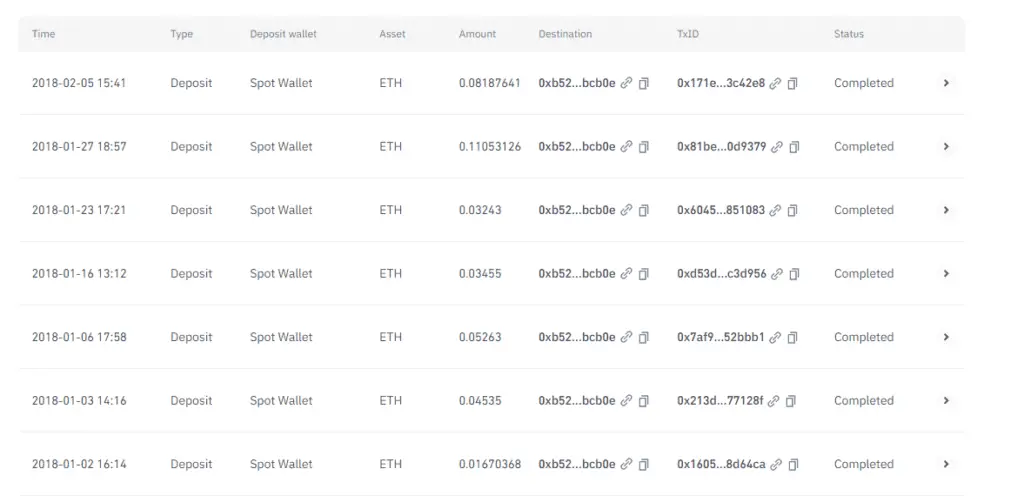

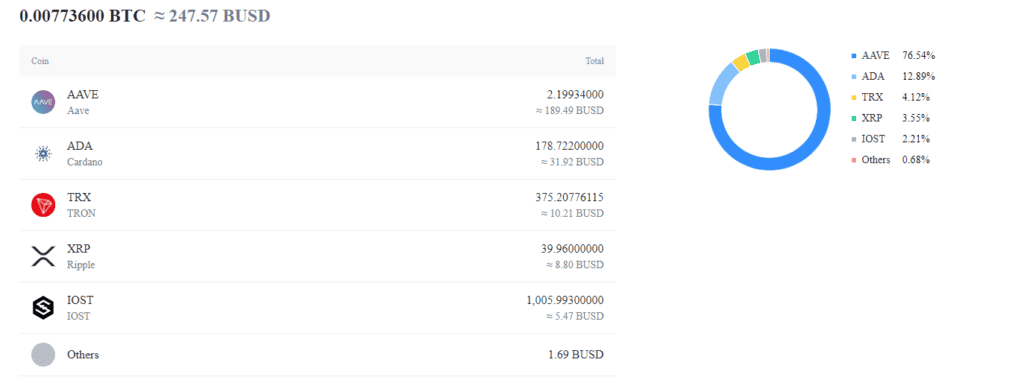

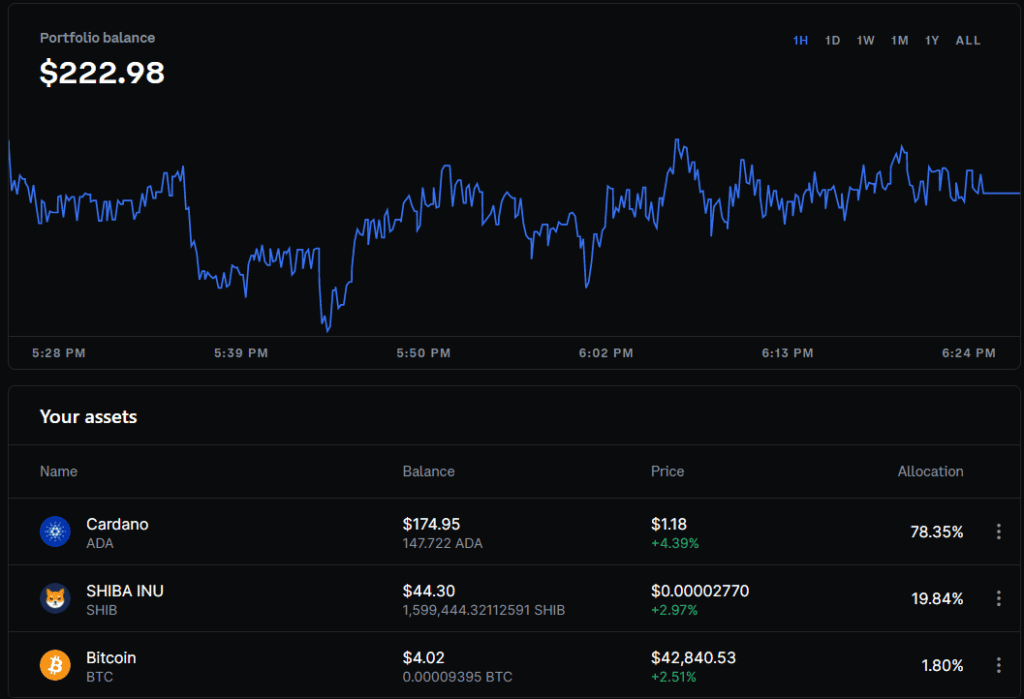

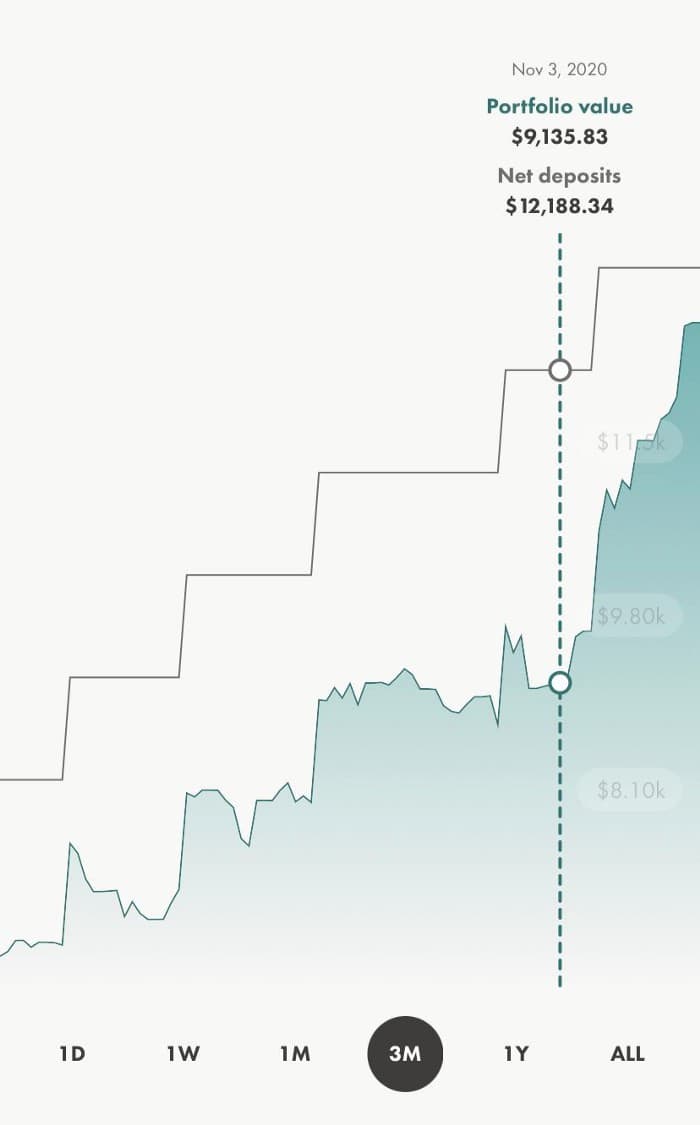

Let’s get right into the numbers. As of November 3, 2020 I had invested a total of $12188 into my Wealthsimple Trading app and my portfolio value was a grand $9135 😂

Yes, I was in negative territory (-25% to be exact).

Here’s a snapshot of the same.

The US Federal Elections took place on November 3, 2020

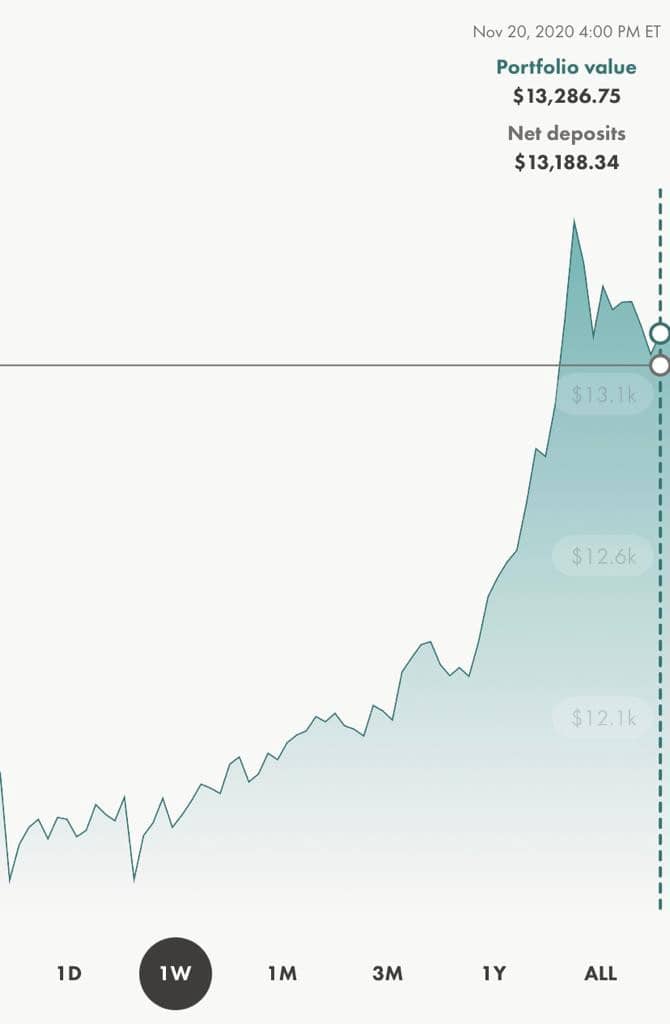

As you can see, I just added another $1k for the month of November (which explains the increase from 12188 to 13188 in Net deposits).

What was really surprising was the increase in my overall portfolio value.

It increased by over $3000 in just two weeks. Talk about market volatility.

How did this happen?

During September 2020, I read multiple articles on what would happen to the US stock market if Donald Trump won again or if Joe Biden won.

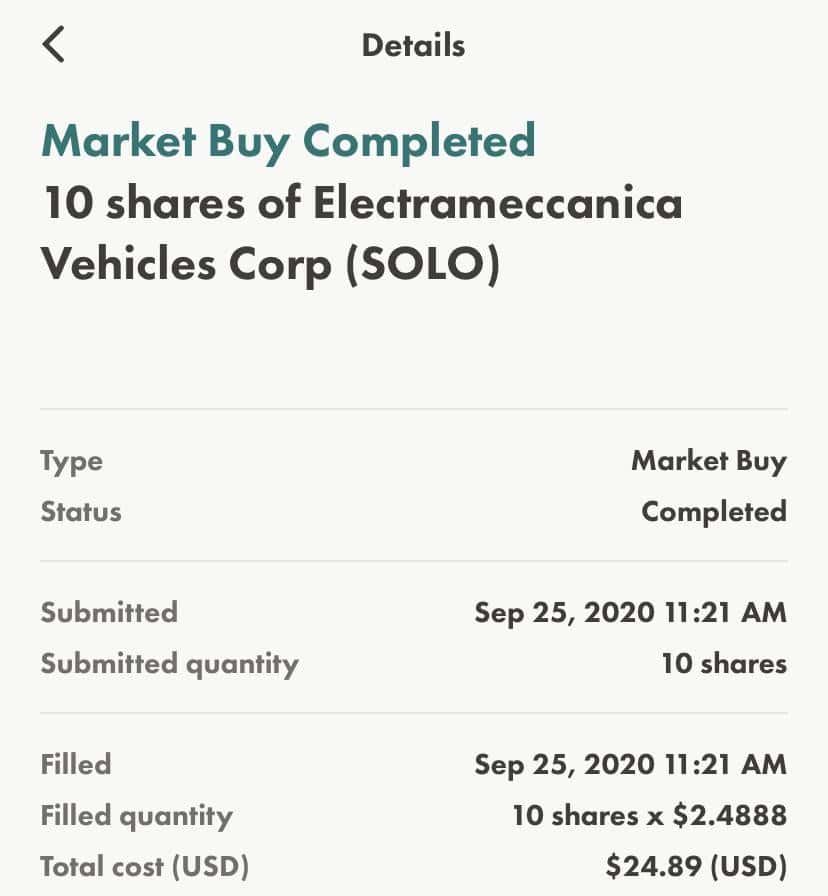

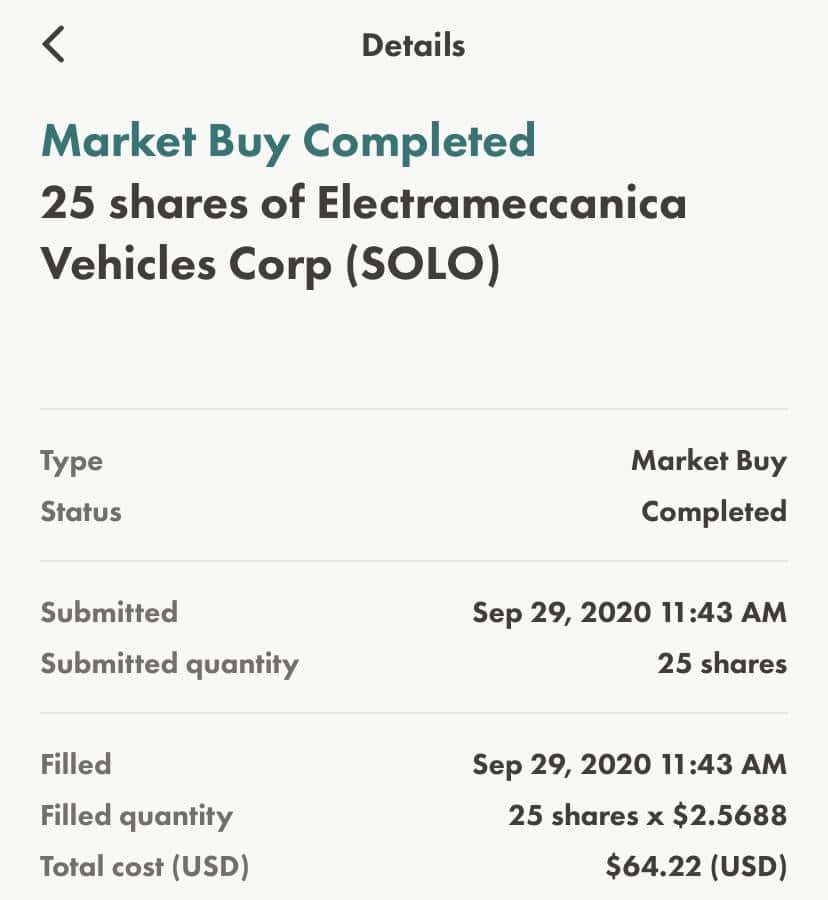

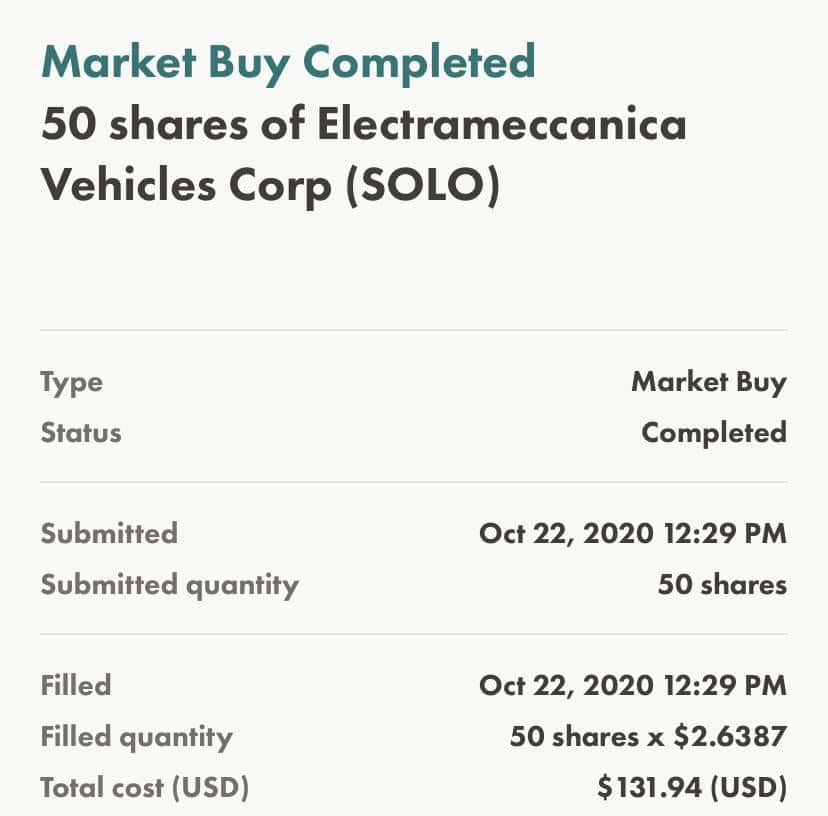

I invested in a few EV penny stocks which were predicted to run on a Biden victory as he had announced plans to fund more tax credits to consumers who buy electronic vehicles.

One such stock was SOLO.

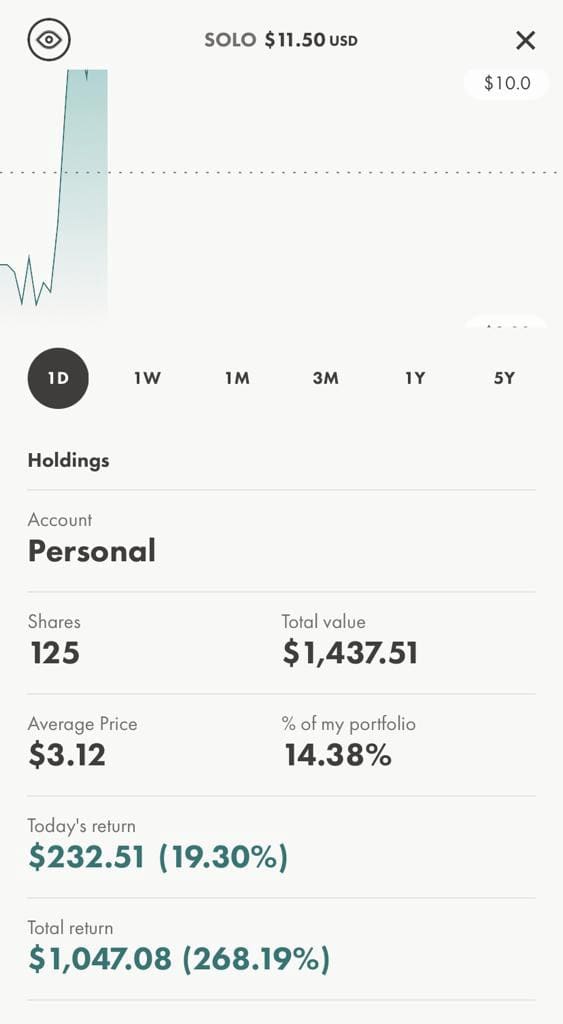

As you can see from the pictures above, I kept buying it in dips and I had around 195 shares on November 12 at an average of $3.12 per share.

It began its bull run right after the elections.

On November 20, it traded briefly around $13.60 apiece. Here’s a snapshot of my holdings in SOLO when it was at $11.50

A whopping 268% return

When it comes to stock market investing, the golden advice is to take profits every now and then, as the profits that you see on screen can disappear in a minute due to something as small as a tweet from someone influential.

So, I did take some profits along the way as well. I started with 195 shares, remember.

This is just one example of how a good stock pick can do wonders in a week and this is one of the reasons why I’m in the green territory right now.

There are many other sectors like Clean Energy, Renewable Energy, Cannabis that look poised for growth in the short term as well as long term.

To summarize – do your due diligence, buy stocks in dips, take profits every now and then, stay invested in booming sectors, and reap the rewards in the long run.

Happy Investing.

Disclaimer: This article is not to be considered as investment advice.