How did the US Federal Elections affect my small portfolio?

The highs and lows in the stock market are often triggered by catalysts. What can be a better catalyst than the US Federal Elections?

I started investing right before the pandemic hit and I continued to invest around $1k every month since March 2020 in the US and Canadian stock markets.

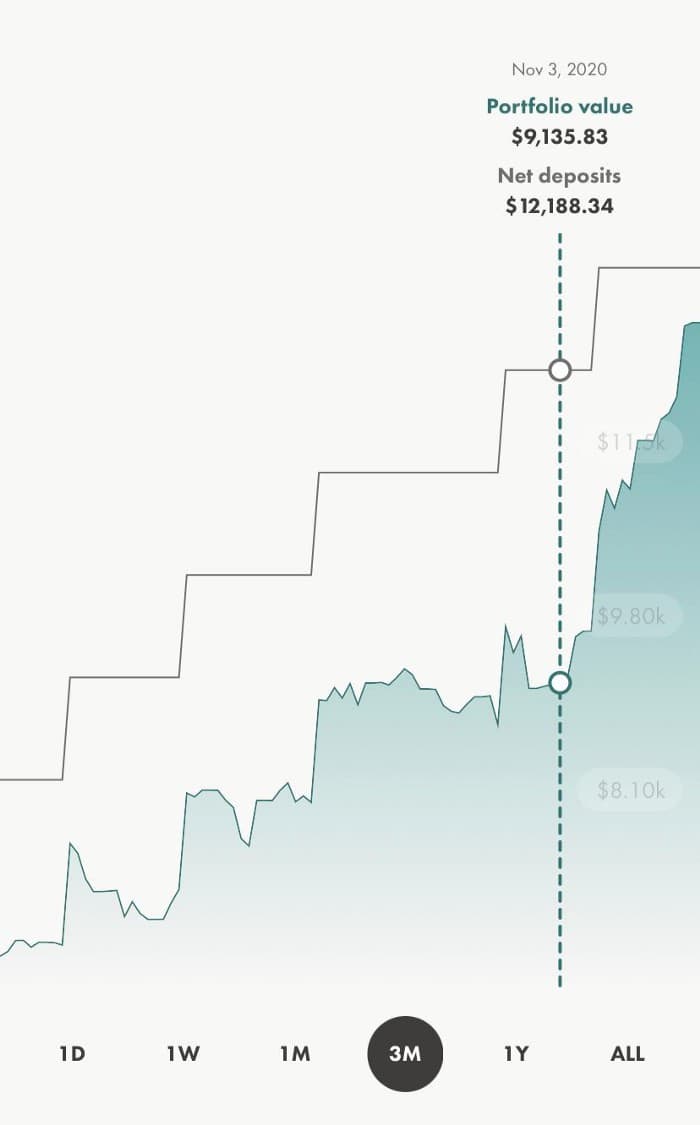

Let’s get right into the numbers. As of November 3, 2020 I had invested a total of $12188 into my Wealthsimple Trading app and my portfolio value was a grand $9135 😂

Yes, I was in negative territory (-25% to be exact).

Here’s a snapshot of the same.

The US Federal Elections took place on November 3, 2020

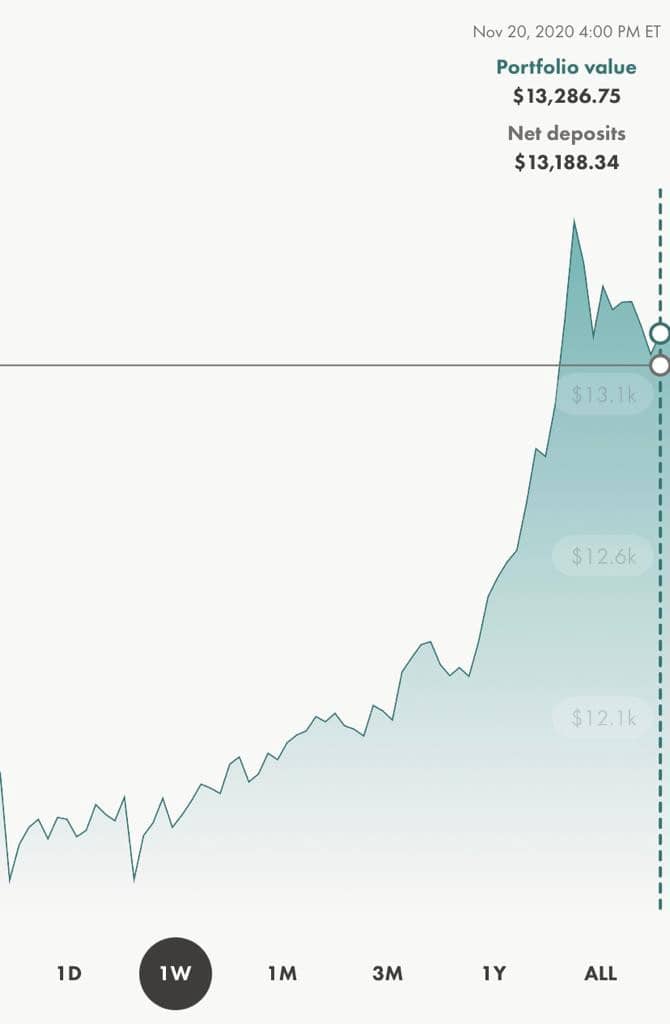

As you can see, I just added another $1k for the month of November (which explains the increase from 12188 to 13188 in Net deposits).

What was really surprising was the increase in my overall portfolio value.

It increased by over $3000 in just two weeks. Talk about market volatility.

How did this happen?

During September 2020, I read multiple articles on what would happen to the US stock market if Donald Trump won again or if Joe Biden won.

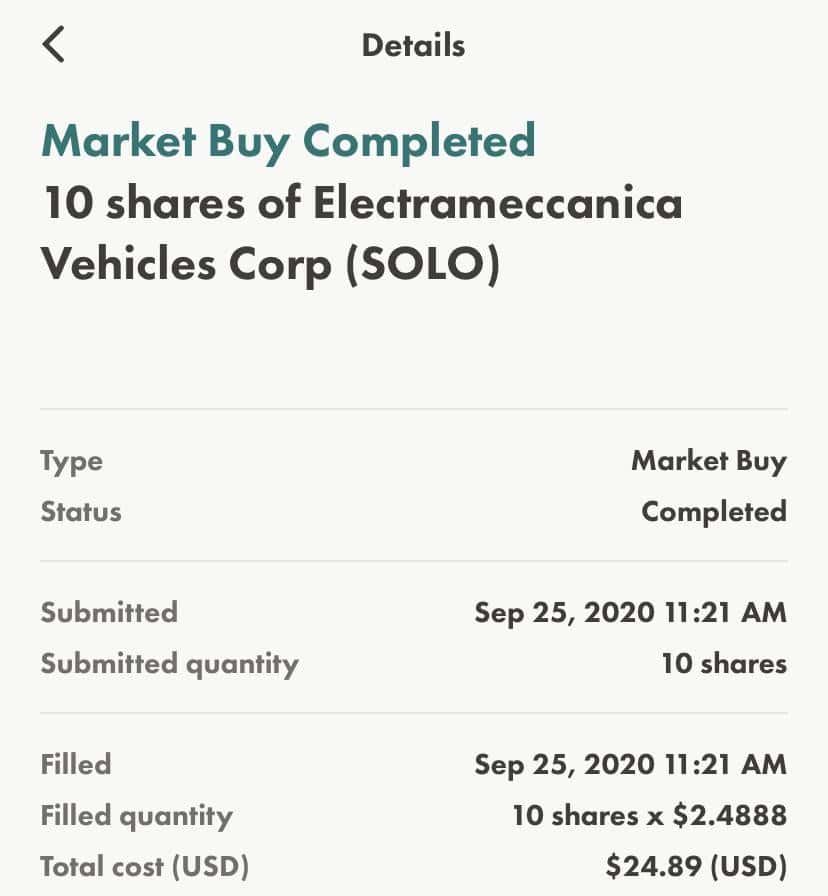

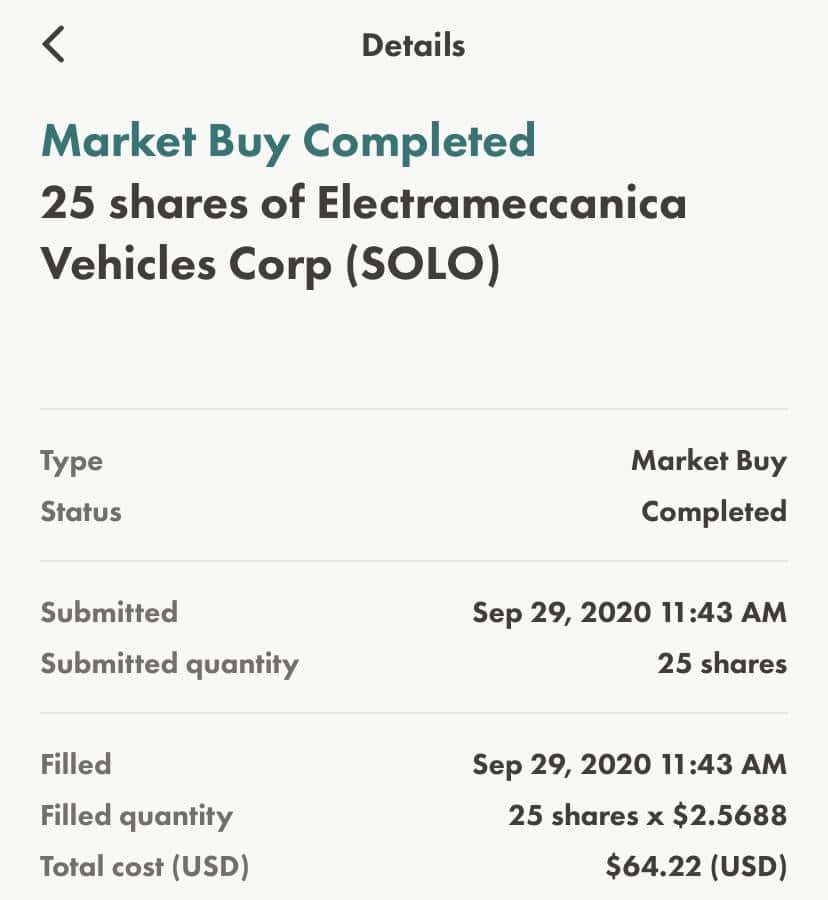

I invested in a few EV penny stocks which were predicted to run on a Biden victory as he had announced plans to fund more tax credits to consumers who buy electronic vehicles.

One such stock was SOLO.

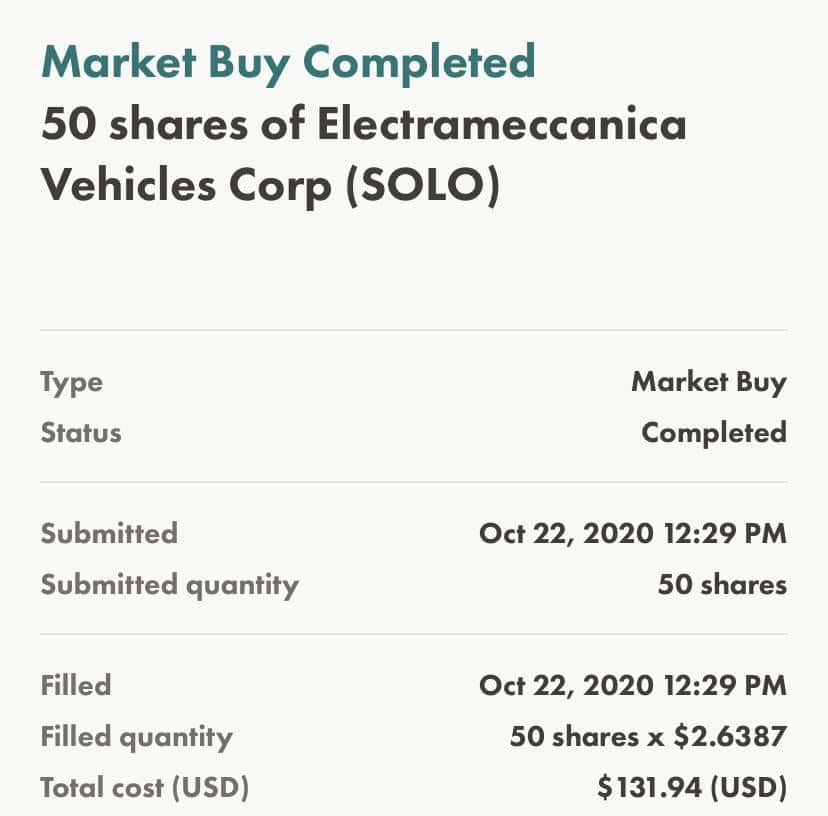

As you can see from the pictures above, I kept buying it in dips and I had around 195 shares on November 12 at an average of $3.12 per share.

It began its bull run right after the elections.

On November 20, it traded briefly around $13.60 apiece. Here’s a snapshot of my holdings in SOLO when it was at $11.50

A whopping 268% return

When it comes to stock market investing, the golden advice is to take profits every now and then, as the profits that you see on screen can disappear in a minute due to something as small as a tweet from someone influential.

So, I did take some profits along the way as well. I started with 195 shares, remember.

This is just one example of how a good stock pick can do wonders in a week and this is one of the reasons why I’m in the green territory right now.

There are many other sectors like Clean Energy, Renewable Energy, Cannabis that look poised for growth in the short term as well as long term.

To summarize – do your due diligence, buy stocks in dips, take profits every now and then, stay invested in booming sectors, and reap the rewards in the long run.

Happy Investing.

Disclaimer: This article is not to be considered as investment advice.

What is Drip Network? Portfolio Snapshot Inside

Every now and then, I come across promising ideas in the crypto space and this is one among them. In this article, we are going to look into the Drip Network.

It is not a coin, but it is a network. Let’s dive deeper into what exactly is DRIP and what’s great about it.

DRIP Network is a project that provides passive income through smart contracts in Defi. It was created on the Binance Smart Chain. DRIP tokens can be bought with BEP20 BNB.

If the above definition sounded too complex to understand, let me break it down in a simple way.

DRIP Network is more like a certificate of deposit that you can buy in your bank. You invest a fixed amount for a specific period of time and in return, your bank provides you with an interest.

How much is the interest provided by DRIP Network?

It’s 1%

It is not 1% per year but 1% every freaking day. So, if you leave it untouched for a year, you are looking at 365% returns.

Sounds too good to be true, right?

We will look into how DRIP Network can provide you such massive returns.

My Journey with DRIP Network

I invested a total of $1000 into DRIP Network in the month of November 2021. I had purchased a total of 33 DRIP tokens over a few days at an average price of $30 per token.

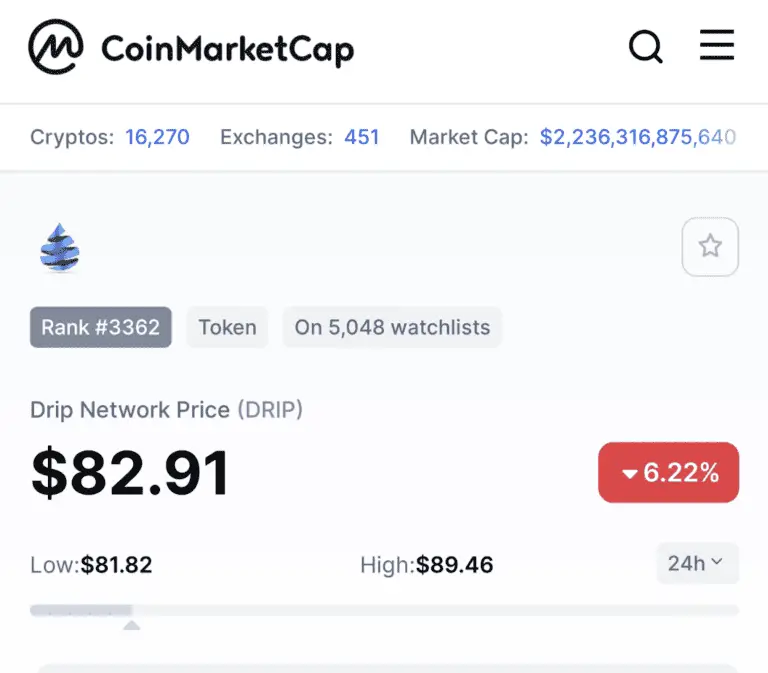

Fast forward to today (Jan 2, 2022), here’s what one DRIP token is trading at.

It has grown from $30 at the end of November 2021 to over $80 at the start of January 2022 as you can see in the 3 months chart below.

The beauty of the DRIP network is not just the 1% daily interest. It also gives you the option to reinvest the 1% so that it can get compounded.

When you reinvest your 1% daily, at the end of 1 year you are looking at a total annual percentage yield (APY) of a whopping 3678% (Fees excluded for simplicity).

Unbelievable right? Let me explain.

$1000 in DRIP Network at the end of day 1 would become $1010 (1% of $1000 is $10)

You have the option to either withdraw the $10 (1% interest) or reinvest it into DRIP Network by an option called ‘Hydrate’

When you hydrate, there is a 5% tax on compounding. This means instead of $10 being reinvested, you will be reinvesting $9.50

So, on Day 2, your $1009.50 will become $1019.59 and you can continue to repeat the process to reach the 3678% return rate in 365 days.

Whether you choose to reinvest (hydrate) or withdraw from the DRIP network, the maximum that you can withdraw in a day is 1% of what you have.

You cannot withdraw all your deposits at once. You can only withdraw 1% at once and this rule applies for everyone invested in DRIP network. This makes it sustainable as there will not be large selloffs that will affect the price of the DRIP token.

Excited to see how my DRIP dashboard looks like? Read on.

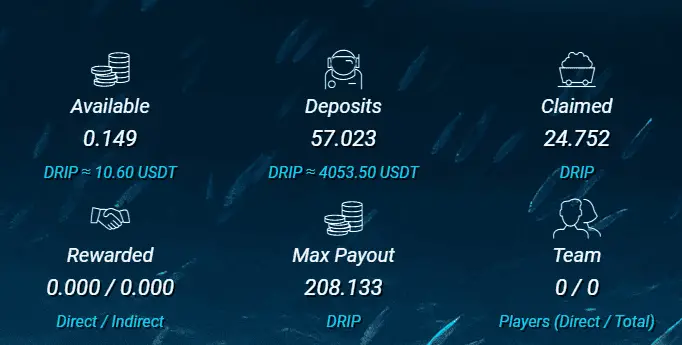

My DRIP Dashboard - Sneak peek

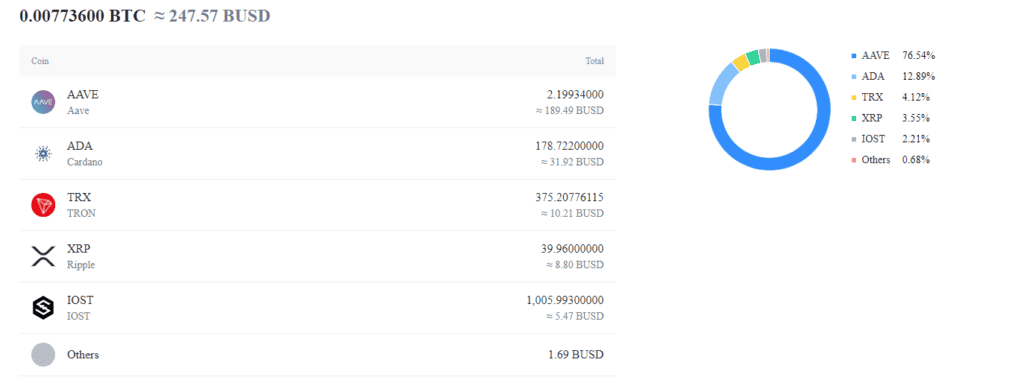

Let’s look at what each of the components in the above snapshot mean.

The first component which says ‘Available’ is the number of drip tokens that is available at that point in time for either withdrawal or reinvesting. As you can see, its 0.29 and at the end of that particular day, it will reach 0.52 which is 1% of the Deposits.

The second component – ‘Deposits’ – This shows the number of DRIP tokens that I own. It includes my purchases as well as the reinvestments of the interest that I received.

The third component – ‘Claimed’ – This shows the total number of DRIP tokens that I’ve earned since I started with DRIP network. It is the sum of all the 1% DRIP tokens that is received everyday. So, in total, I started with around 33 DRIP tokens, and I’ve earned 19.79 more tokens by compounding everyday.

The fourth component – ‘Rewarded’ – DRIP network also rewards you when you refer people to DRIP. When someone joins directly through your buddy link, a portion of their tax comes to you, and it goes under Direct. When your direct downline refers DRIP someone, you will get rewarded too and they go under Indirect. All rewards are in the form of DRIP tokens that you can choose to withdraw or reinvest. We can dive deeper about DRIP referrals in a different article.

The fifth component – ‘Max Payout’ – At any given point in time, Max payout is calculated by total deposits multiplied by 3.65

The sixth component – ‘Team’ shows the number of people who signed up using your buddy link into DRIP network. Even if you do not refer anyone, nothing changes. When you refer someone, you get more DRIP from their deposits. Just makes your DRIP portfolio bigger and bigger as everything compounds when you keep hydrating.

This is just an introduction to DRIP Network and I will be adding more content on how to purchase DRIP tokens in Canada.

Disclaimer: As always, investing in crypto or stocks comes with a set of risks. Please do your own due diligence and this article is not to be considered as financial advice.